Balance of Time Deposits at 5 Major Banks Recently Surges

Toss Bank Offers 2% Interest Rate Without Conditions... Signal of Competition

Internet Banks and Commercial Banks Also Present High-Interest Special Promotions One After Another

[Asia Economy Reporter Kim Jin-ho] Office worker Kim Taekyun (35, pseudonym) recently signed up for deposits at Toss Bank and the First Salary Dream installment savings product at Shinhan Bank to accumulate a lump sum. Kim, who has been working for six years, had actively invested in asset markets such as stocks and cryptocurrencies but changed his mind to invest in safe assets after suffering significant losses due to the recent unstable market conditions. Compared to stocks, the returns are lower, but the principal is guaranteed, and interest rates have risen compared to before, making it suitable for the purpose of accumulating a lump sum.

Consumer interest in bank deposits and installment savings, which had been overlooked as investment options during the prolonged low-interest-rate period, is reviving. This is because the Bank of Korea’s monetary policy normalization is raising deposit interest rates, and the preference for safe assets is spreading amid stock market instability.

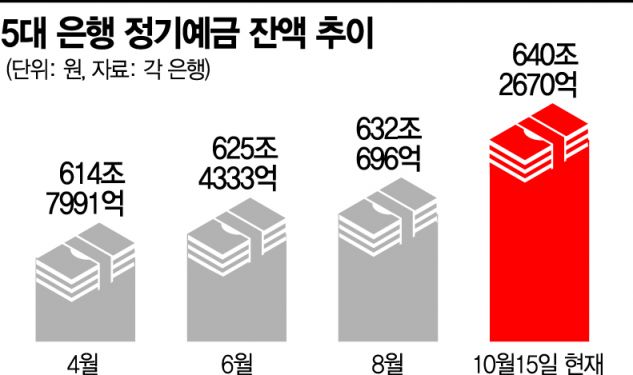

According to the financial sector on the 24th, the balance of time deposits at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?stood at 640.267 trillion won as of the 15th, a sharp increase of 7.8436 trillion won compared to 632.4234 trillion won at the end of September. This is the largest increase since May (9.5564 trillion won increase).

The increase was also influenced by major commercial and internet banks raising deposit and installment savings interest rates following the base rate hikes. In particular, the recent launch of Toss Bank, which introduced high-interest products without conditions, is seen as a trigger for sparking interest rate competition.

Toss Bank’s deposit products are characterized by offering a 2% interest rate unconditionally. Interest is provided for the exact number of days the money is deposited, even if it is withdrawn early, allowing customers to enjoy benefits even with mid-term cancellations.

Due to these exceptional benefits, consumer response has been enthusiastic. Toss Bank’s pre-registration customers number about 1.6 million. Currently, about 400,000 to 500,000 have newly signed up, and Toss Bank plans to complete account openings for the remaining approximately 1 million pre-registered customers within this month.

Internet banks launched earlier, such as Kakao Bank and K Bank, also offer relatively higher interest rates compared to commercial banks. Since the 1st, K Bank has raised the interest rate of its ‘CodeK Time Deposit’ to 1.5%. After the base rate hike announcement in August, it had already increased deposit interest rates by 0.2 percentage points. Kakao Bank raised deposit and installment savings interest rates by 0.3 to 0.4 percentage points last month. For deposits, it offers 1.5%, and for installment savings, 1.8% interest when automatic transfers are used.

Commercial banks have also recently introduced high-interest deposit products one after another. IBK Industrial Bank launched the ‘IBK Altos Installment Savings,’ a flexible installment savings product that offers preferential interest rates based on the performance of the Altos volleyball team in the ‘Dodram 2021?2022 V-League.’ The contract period is one year, with a maximum monthly deposit of 500,000 won, and sales are limited to 50,000 accounts until the end of the year. The basic interest rate is 1.00% per annum, with a maximum preferential interest rate of 2.00 percentage points, making the highest interest rate 3.00% per annum.

Shinhan Bank is selling the ‘First Salary Dream’ installment savings product targeting office workers. It offers preferential interest rates to salary transfer customers, with a high interest rate of up to 4.40% per annum. It is popular because not only new employees but also customers transferring their salary accounts can receive preferential interest benefits. Hana Bank applies up to 3.5% compound interest annually depending on card usage performance for new employees aged 35 or younger who subscribe to the ‘Salary Hana Monthly Compound Installment Savings.’

Although somewhat demanding, products offering up to 7% annual interest rates if conditions are met are also noteworthy. Woori Bank’s ‘Woori Magic Installment Savings by Lotte Card’ guarantees up to 7% interest depending on transaction performance with Woori Bank and Lotte Card usage. K Bank, in partnership with Woori Card, is also selling the ‘Hot Deal Installment Savings x Woori Card’ product, which offers a high interest rate of 10% by adding a maximum preferential interest rate of 8.2% to the base rate of 1.8%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.