[Asia Economy Reporter Seungjin Lee] As the home meal replacement (HMR) market grows, consumers' criteria for choosing products have also changed. It has been found that consumers prefer products made with tastier and healthier ingredients rather than simply cheaper options.

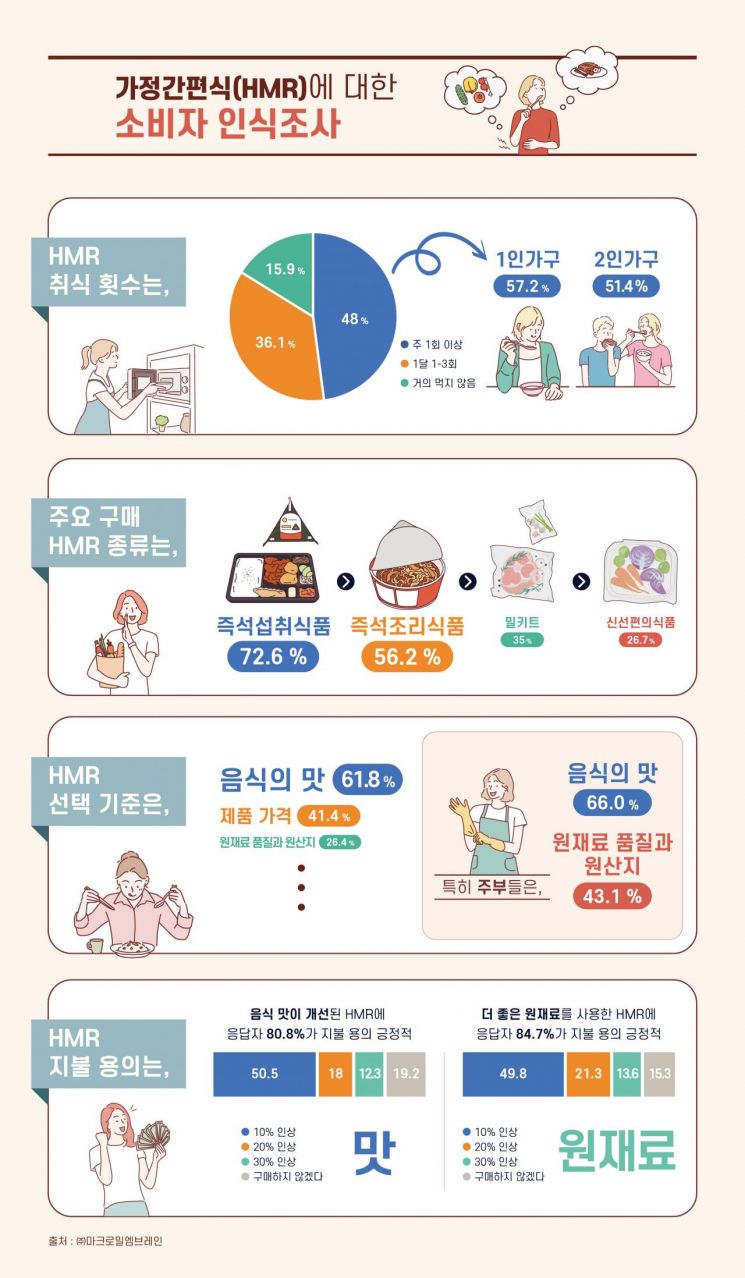

On the 23rd, research firm Macromill Embrain conducted a survey on the perception of HMR among 1,000 general consumers, revealing that 48% of respondents eat home meal replacements at least once a week.

According to the survey results, the consumption frequency was particularly high among single-person households (57.2%) and two-person households (51.4%), indicating that HMR is becoming more common as the number of household members decreases.

The main types of HMR purchased were ready-to-eat foods such as lunch boxes and gimbap (72.6%), and instant cooking foods like ramen, instant rice, and soups (56.2%), which still accounted for a large proportion. Meal kits (35%) and fresh convenience foods such as salads and easy-to-eat fruits (26.7%) also held a significant share.

By occupation, job seekers and students showed overwhelmingly high usage rates of ready-to-eat foods at 96.8% and 83.3%, respectively, while full-time homemakers had the highest meal kit usage rate at 51.4% compared to other occupations.

The most important criterion when choosing HMR was the taste of the food (61.8%). This was followed by product price (41.4%), quality or origin of raw materials (26.4%), ease of preparation (23.1%), reviews and evaluations from others (12.2%), product quantity (10.2%), and brand (6.2%). In particular, full-time homemakers, who are the main household consumers, placed even greater importance on food taste (66%) and the quality and origin of raw materials (43.1%).

The biggest dissatisfaction with HMR across all age groups was the concern that they might contain large amounts of artificial additives, at 49.3%. This was followed by insufficient food quantity (33.1%), high price (31.4%), concerns about hygiene (28.9%), and worries about the origin or quality of ingredients (26.5%). Especially among full-time homemakers (58.3%) and households with three or more members with children (53.7%), concerns about artificial additives were the highest.

Regarding ramen, a representative HMR product, more than half of respondents (52.3%) eat ramen at least once a week, but concerns about sodium (79.4%), artificial additives (38.1%), and calories (35.8%) still remain.

For instant rice, which is growing as a staple food for one- and two-person households, respondents indicated the need for quality improvements such as the smell when opening the package (38.5%), variety of rice types available (34.2%), texture of rice grains (29.6%), and product freshness (25.3%).

In fact, many respondents expressed willingness to pay a certain premium if HMR products with improved taste and better raw materials were released to address these complaints.

When asked about HMR products with improved taste, the majority of respondents (80.8%) said they would accept a price increase. Additionally, 84.7% indicated they would be willing to purchase products even if the price rose somewhat, provided better quality ingredients were used, showing that consumers desire improvements in ingredient quality.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)