Demand Forecast Competition Ratio 1714 to 1

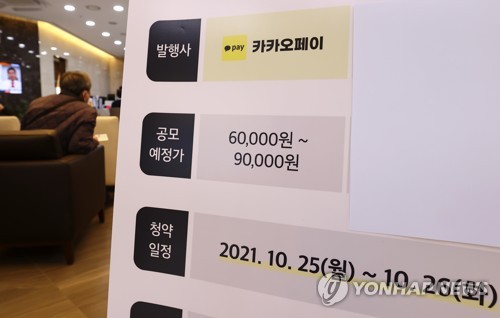

[Asia Economy Reporter Hwang Yoon-joo] Kakao Pay has set its public offering price at the top end of the desired range, 90,000 KRW, ahead of its listing next month.

Kakao Pay announced on the 22nd that the institutional demand forecast, which closed on the 21st, resulted in a public offering amount of 1.53 trillion KRW. The market capitalization after listing is 11.7 trillion KRW. A total of 1,545 domestic and overseas institutional investors participated in the demand forecast. The competition rate was 1,714.47 to 1.

Of these, 99.99% applied at a price of 90,000 KRW or higher, which is the top end of the desired public offering price. The total amount of institutional public offering participation reached 151.8 trillion KRW.

Among the domestic and overseas institutions participating in the demand forecast, the ratio of lock-up commitments ranged from a minimum of 1 month to a maximum of 6 months, reaching 70.4%, the highest figure among companies that raised more than 1 trillion KRW through IPOs since 2014.

Kakao Pay will conduct a general investor subscription for 4.25 million shares, which is 25% of the total volume, on October 25-26, and will be listed on November 3. Notably, it will be the first domestic IPO to allocate 100% of the shares for general subscribers equally.

Individual investors can subscribe through the lead underwriter Samsung Securities, as well as Daishin Securities, Korea Investment & Securities, and Shinhan Financial Investment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.