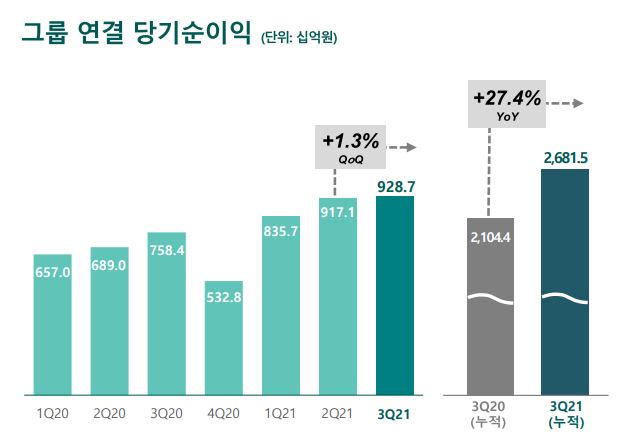

Increase of 577.1 Billion KRW Compared to Previous Year

9.287 Billion KRW Realized in Q3

Key Asset Soundness Indicators Stabilize at Lower Levels

[Asia Economy Reporter Kiho Sung] Hana Financial Group announced on the 22nd that it recorded a cumulative consolidated net income of 2.6815 trillion KRW, including 928.7 billion KRW in the third quarter of this year. This represents a 27.4% (577.1 billion KRW) increase compared to the same period last year.

This result was driven by continuous growth in the non-bank sector due to business portfolio diversification (965.8 billion KRW, contribution ratio 36.0%, up 4.7 percentage points from the same period last year) and stable cost management.

Major non-bank affiliates contributed to the group's sustained growth by posting net incomes of 409.5 billion KRW (up 123.2 billion KRW, 43.0% increase YoY) for Hana Financial Investment, 199.0 billion KRW (up 84.6 billion KRW, 73.9% increase YoY) for Hana Card, and 193.1 billion KRW (up 66.0 billion KRW, 51.9% increase YoY) for Hana Capital in the cumulative third quarter.

Hana Financial Group continued a solid core profit growth trend through an increase in corporate-centered loan assets and diversification of fee income. The cumulative core profit for the third quarter, combining interest income (4.9941 trillion KRW) and fee income (1.8798 trillion KRW), rose 14.2% (854.6 billion KRW) year-on-year to 6.8739 trillion KRW. The group's net interest margin (NIM) for the third quarter was 1.64%.

Cost efficiency improved through digital innovation and company-wide cost reduction efforts, stabilizing the group's third-quarter selling and administrative expenses below 1 trillion KRW for the second consecutive quarter. The cost-to-income ratio (C/I Ratio) recorded 44.2%, maintaining favorable cost efficiency.

Additionally, despite maintaining conservative provisioning standards this year, the group recorded a low loan loss cost ratio of 0.11%, improved by 13 basis points compared to the same period last year, thanks to sufficient loss absorption capacity secured by proactively setting aside COVID-19 related economic response reserves last year. As a result of pursuing a growth strategy considering risks, risk-weighted assets were stably managed, and net income continued to increase, with the group's estimated BIS ratio rising 4 basis points from the previous quarter to 16.58%, and the estimated common equity tier 1 ratio at 14.06%. Key management indicators showed a return on equity (ROE) of 11.23% and a return on assets (ROA) of 0.76%. The group's total assets, including trust assets of 146 trillion KRW as of the third quarter of 2021, amounted to 649 trillion KRW.

The group's asset soundness indicators also maintained stability. At the end of the third quarter, the group's non-performing loan ratio was 0.33%, improved by 3 basis points from the previous quarter, and the group's NPL coverage ratio increased by 5.5 percentage points from the previous quarter to 156.8%. The delinquency rate remained steady at a favorable level of 0.28%, unchanged from the previous quarter.

Hana Bank Posts 694 Billion KRW in Q3... Cumulative Net Income of 1.947 Trillion KRW

Hana Bank recorded a cumulative consolidated net income of 1.947 trillion KRW, including 694 billion KRW in the third quarter of 2021. This is a 17.7% (292.6 billion KRW) increase compared to the same period last year, resulting from an increase in SME-centered loan assets and core low-interest deposits that offset one-time costs such as non-monetary foreign exchange losses due to exchange rate rises.

The cumulative core profit for the third quarter, combining interest income (4.4746 trillion KRW) and fee income (552 billion KRW), was 5.026 trillion KRW, up 10.5% (479 billion KRW) year-on-year. The third-quarter net interest margin (NIM) was 1.40%. At the end of the third quarter, the non-performing loan ratio was 0.27%, and the delinquency rate was 0.19%, the lowest level since the bank merger in 2015, maintaining a downward stabilization trend. The bank's total assets, including trust assets of 70 trillion KRW as of the third quarter of 2021, amounted to 502 trillion KRW.

Hana Financial Investment posted a cumulative net income of 409.5 billion KRW for the third quarter, up 43.0% (123.2 billion KRW) year-on-year, driven by increased asset management fees.

Hana Card recorded a cumulative net income of 199.0 billion KRW for the third quarter, up 73.9% (84.6 billion KRW) year-on-year, due to increased payment-related fee income.

Hana Capital posted 193.1 billion KRW, Hana Life Insurance 22.8 billion KRW, and Hana Asset Trust 69.2 billion KRW in cumulative net income for the third quarter, respectively.

Lee Hoo-seung, Executive Vice President and Chief Financial Officer of Hana Financial Group, said at the earnings announcement, "As supply chain bottlenecks and rising crude oil and raw material prices threaten the global economy, inflation is rising sharply, and signs of slowflation are emerging both domestically and internationally. Hana Financial Group will thoroughly prepare for external and internal economic threats while strengthening fundamentals through a growth strategy focused on high-quality assets and conservative risk management."

He added, "Based on a high level of capital strength, we will consider various measures to enhance shareholder value. We will actively cooperate with the government's COVID-19 support efforts and listen to social voices calling for fairness and equality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)