Bank 16.9%, Securities 60.5%, Non-life Insurance 44.3%, Card 46.6% Increase

[Asia Economy Reporter Park Sun-mi] KB Financial Group has signaled a positive outlook for achieving a net profit (controlling interest net income) of 4 trillion KRW this year. From the first to the third quarter of this year, it recorded a net profit of 3.7722 trillion KRW, surpassing last year's total of 3.4552 trillion KRW.

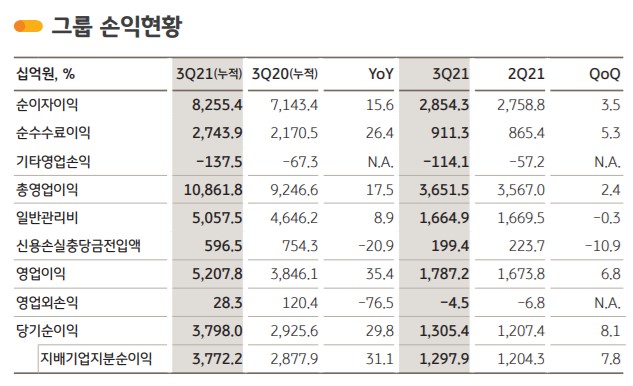

On the 21st, KB Financial announced that its third-quarter net profit reached 1.2979 trillion KRW, an 11.3% increase compared to the same period last year. Compared to the previous quarter, it rose by 7.8%. Stable net interest income and increased net fee income, along with a decrease in credit loss provisions, contributed to the rise in net profit.

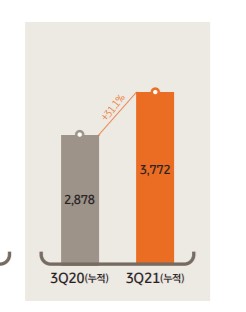

On a cumulative basis for the third quarter, net profit was 3.7722 trillion KRW, up 31.1% (894.3 billion KRW) from 2.8779 trillion KRW in the same period last year. This surpassed last year's total performance, marking the highest record ever. Cumulative net interest income increased by 15.6% to 8.2554 trillion KRW, and net fee income rose by 26.4% to 2.7439 trillion KRW. This is interpreted as the result of expanding the revenue base through strengthening core businesses by business segment and diversifying the business portfolio through mergers and acquisitions (M&A).

As of the end of September, KB Financial's total assets stood at 650.5 trillion KRW, and the group's total assets including assets under management (AUM) amounted to 1,121.8 trillion KRW (based on simple aggregation of group affiliates). The group's asset soundness remained stable. The non-performing loan (NPL) ratio improved by 0.03 percentage points from the end of June to 0.36%.

KB Financial Group Net Income

KB Financial Group Net Income

KB Kookmin Bank's Net Profit for Q1-Q3 Up 16.9%

KB Securities' Net Profit for Q1-Q3 Up 60.5%

Among major affiliates, KB Kookmin Bank recorded a cumulative net profit of 2.2003 trillion KRW for the first three quarters, a 16.9% (317.9 billion KRW) increase compared to the same period last year. Interest income grew steadily due to asset growth from M&A and stable loan growth, while fee income expanded thanks to increased trust income and IB business-related profits. Proactive risk management led to a decrease in credit loss provisions, and the impact of additional COVID-19 related loan loss provisions from last year also dissipated.

KB Securities' cumulative net profit for the third quarter was 543.3 billion KRW, up 60.5% (204.8 billion KRW). The stock market boom increased stock trading volume and customer custody assets, boosting custody fees. Additionally, IB business fees and capital market-related profits improved significantly, leading to balanced performance improvements across all business divisions, including WM, IB, and S&T, through efforts to strengthen competitiveness in core businesses.

KB Insurance's cumulative net profit for the third quarter was 269.2 billion KRW, a 44.3% (82.6 billion KRW) increase. Insurance profits expanded due to overall loss ratio improvements centered on automobile insurance, along with increased investment income influenced by higher dividends from investment funds. KB Kookmin Card posted a cumulative net profit of 374.1 billion KRW, up 46.6% (118.9 billion KRW). This was driven by improved interest income from business combinations due to M&A, increased card usage, and company-wide marketing cost efficiency efforts that boosted fee income.

Prudential Life Insurance recorded a cumulative net profit of 255.6 billion KRW for the third quarter. Stable growth in interest income, improved insurance profits due to a higher proportion of savings-type product sales reducing new contract costs, and expanded investment income through strategic asset sales contributed to solid performance.

"Limited Possibility of Rapid Asset Quality Deterioration After Financial Support Ends"

At the earnings announcement event, KB Financial Vice Chairman Lee Hwan-joo addressed concerns about asset quality amid the possibility of further base rate hikes and the extension of various financial support programs, stating, “KB is proactively preparing for potential risks based on a thorough risk management system.” He added that KB has secured sufficient buffers by setting aside approximately 380 billion KRW in additional provisions last year to respond to future uncertainties, so the possibility of rapid asset quality deterioration after the end of financial support is limited.

Vice Chairman Lee also provided detailed information about the group's new flagship digital platform, ‘KB Star Banking,’ which will be launched at the end of this month. He emphasized, “The new ‘KB Star Banking’ is an expandable comprehensive financial platform that serves as a hub by offering core services from each affiliate in a single app. Users can access the representative core services of affiliates without additional app installations or leaving the app, and it features a flexible platform that seamlessly connects with external channels such as Government24 and Hometax, while providing data-driven personalized services.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.