[Asia Economy Reporter Kang Nahum] Domestic game companies are expanding their investments in ‘social casino games.’ This is interpreted as an effort to secure a stable revenue structure regardless of the success of new releases and to seek new opportunities through overseas market expansion.

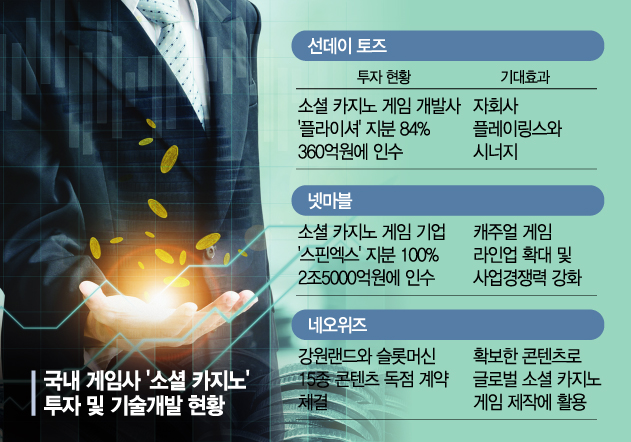

◆ Game Companies Dreaming of ‘Jackpots’ = According to the industry on the 20th, SundayToz recently decided to acquire 84% of the shares, totaling 33,297 shares, of the social casino game developer ‘Flycer.’ The acquisition amount is 36 billion KRW, the largest investment/acquisition amount since the establishment of SundayToz. Flycer’s main game is the app-based social casino Lock & Cash, which operates 200 slot machines.

Starting from mid-next month, after completing the acquisition process, they plan to begin full-scale collaboration. SundayToz expects stable business expansion and various synergy effects through cooperation with its subsidiary Playlinks.

Prior to this, Netmarble acquired the social casino game company ‘SpinX’ for 2.5 trillion KRW. This is the largest M&A in the history of domestic game companies. SpinX is the third-largest global mobile social casino game company, and Netmarble expects SpinX to contribute to expanding its casual game lineup and strengthening business competitiveness.

Neowiz signed a content contract this year for 15 types of ‘KL Saberi’ slot machines developed by Kangwon Land. Accordingly, Neowiz will have exclusive use of all slots developed by Kangwon Land for five years. Neowiz plans to utilize the secured content for domestic and global social casino game production. Currently, the two companies are jointly developing online social games and offline slot machine resources, and plan to develop business models for online-to-offline (O2O) linked businesses in the future.

◆ Growth Potential and Gambling Concerns... Clear Pros and Cons = The expansion of game companies’ investments in social casino games is due to the market’s growth potential. With offline casino usage decreasing due to COVID-19, demand for social casinos that can be enjoyed on mobile devices has exploded. According to global market research firm Eilers & Krejcik Gaming, the global social casino market was $7 billion (approximately 8.31 trillion KRW) last year and is expected to grow at an average annual rate of 4.2%, reaching $8.6 billion (approximately 10.21 trillion KRW) by 2026.

In particular, social casino games are considered a high-profit area that does not require significant development efforts. In the case of Netmarble’s SpinX, Q1 sales this year reached 162.2 billion KRW, and sales for the first half increased by 46% year-on-year to 328.9 billion KRW. From Q4 this year, with consolidated financial results included, Netmarble is aiming for annual sales of ‘3 trillion KRW’ this year.

Flycer, which SundayToz is acquiring, recorded sales of 30.1 billion KRW and operating profit of 1.3 billion KRW last year, mainly targeting overseas Google and Apple open markets. In the first half of this year, it continued its sharp growth with sales of 14.9 billion KRW and operating profit of 1.7 billion KRW.

However, the issue of gambling addiction is a challenge these game companies must overcome. Since the perception equating slot games with gambling remains strong, there is a considerable possibility that regulatory authorities such as the Game Rating and Administration Committee may expand regulations in the future. Currently, paid services for social casino games are prohibited in Korea. For this reason, game companies are attempting to enter overseas markets where social casino games are classified as pure games.

There are also concerns that this could hinder the growth momentum of the domestic game industry. Professor Wi Jung-hyun of Chung-Ang University, president of the Korea Game Society, said, “Social casino games serve more as a cash cow rather than helping the development of core online and mobile games. While they contribute to revenue, they are unlikely to create synergy with the core business in the long term.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.