[Asia Economy Reporter Su-yeon Woo] Starting next year, as the United States begins to actively reduce quantitative easing (tapering), there is an analysis that South Korea's exports to emerging countries with vulnerable fiscal conditions may slow down.

According to the report titled "The Impact of US Tapering on Emerging Economies and Our Exports," released on the 21st by the Korea International Trade Association's International Trade and Commerce Research Institute, tapering implemented by the US after the past global financial crisis expanded uncertainty in emerging economies with high fiscal risks and somewhat affected South Korea's exports to these emerging countries.

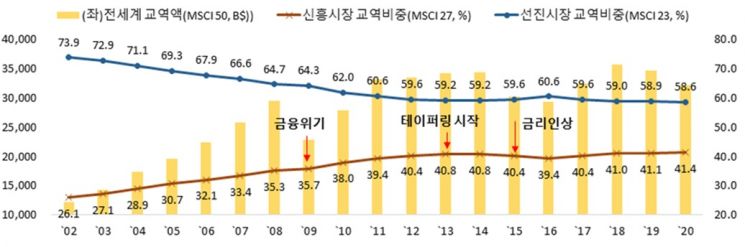

The report pointed out that the share of emerging countries in global trade steadily increased from 26.1% in 2002 to 40.8% in 2014, but since the US initiated tapering in 2014, the share of emerging countries in trade has stagnated at around 40%.

In particular, countries classified as fiscally vulnerable during the financial crisis, such as Brazil, India, Indonesia, Turkey, and South Africa, suffered significant impacts. In 2015, when interest rate hikes began in earnest, these countries' global imports decreased by 10% compared to the previous year, and in 2016, they decreased by as much as 18%. Additionally, in 2016, the share of these countries in global trade and import markets declined by 1.0 percentage point and 0.6 percentage point respectively compared to 2013. As import demand in emerging countries contracted, South Korea's export share to emerging countries also fell by 1.4 percentage points from 54.7% in 2013 to 53.3% in 2016.

Trends in the Share of Trade between Advanced and Emerging Markets in Global Trade (2002-2020, Unit: Billion USD, Share %)

Trends in the Share of Trade between Advanced and Emerging Markets in Global Trade (2002-2020, Unit: Billion USD, Share %) Source: KITA, WTO

However, the report analyzed that considering exports to the five major emerging countries?China, Vietnam, Taiwan, India, and Mexico?account for about 75% of South Korea's total exports to emerging countries, even if exports to some emerging countries decrease due to future US tapering, the overall impact on total exports will be somewhat limited. Among the 30 major emerging countries, only 12 countries account for more than 1% of South Korea's total exports, and only Vietnam (8.7%) and China (25.1%) exceed a 5% export share.

Furthermore, the report anticipated that if the US dollar strengthens for a prolonged period ahead of tapering, the burden on domestic export manufacturing industries that import raw materials will increase. Generally, a stronger dollar leads to a rise in the won-dollar exchange rate, which can lower the export price of final products and secure price competitiveness. However, in a situation like this year where international raw material prices are soaring, a simultaneous rise in the exchange rate could further increase the burden of raw material imports.

In fact, emerging economies have recently shown signs of contraction ahead of the US tapering implementation. Since the Jackson Hole Symposium in August, as tapering has gained momentum within the year, emerging market stock prices have been somewhat weak, and interest rate hikes are expanding to neighboring countries such as Turkey, Brazil, Mexico, and Colombia. Particularly, some emerging countries like Greece, Egypt, and India are suffering from chronic trade deficits, and the risk of fiscal crisis is intensifying as government debt exceeds 80% of their gross domestic product (GDP).

Jisang Hong, a research fellow at the Korea International Trade Association, emphasized, "With inflationary pressures increasing worldwide, including in the US, the tapering clock is moving faster than expected. It is necessary to carefully monitor the direction and pace of US tapering, including the Federal Open Market Committee (FOMC) meeting in November, and to minimize transaction risks through thorough buyer credit investigations when dealing with emerging countries with high fiscal risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.