[Asia Economy Reporter Park Sun-mi] More than half of small and medium-sized enterprises (SMEs) expect the sluggish business conditions experienced last year due to the impact of COVID-19 to continue this year as well.

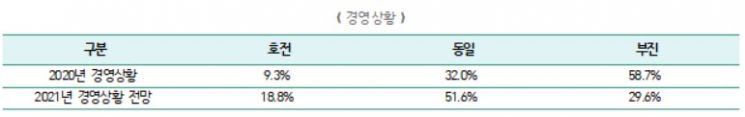

According to the ‘2021 SME Financial Status Survey’ released by IBK Industrial Bank of Korea on the 19th, 51.6% of SMEs responded that business conditions would remain the same as last year through this year. Those who expected conditions to worsen this year accounted for 29.6%, while only 18.8% answered that conditions would improve.

Regarding funding demand outlook, the responses were the same as the previous year (64.9%), decrease (20.3%), and increase (14.8%) in order. The main reasons for expecting increased funding demand were payment for purchases (67.2%) and payroll expenses (57.5%), while the majority of those expecting decreased funding demand cited sales decline (90.8%).

These survey results can be interpreted as domestic SMEs striving to improve management efficiency and overcome the damages caused by COVID-19 amid difficult internal and external conditions.

Meanwhile, companies anticipated that external financing would become more difficult due to the continued sluggish business conditions since last year. Among the respondents, 93.0% expected funding procurement to be similar to or more difficult than the previous year, and the actual plan to raise external funds decreased by 8.6 percentage points compared to the previous year, showing 12.5%.

An IBK Industrial Bank official stated, “Even as COVID-19 prolongs, IBK, as a policy bank, plans to continue efforts to enhance the competitiveness of SMEs.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.