Due to Soaring House Prices and Stricter Tax Policies, 7 out of 10 Say "Now Is Not the Time to Buy"

Looking into Key Market Indicators

Transaction Supply-Demand Index Declines for 5 Consecutive Weeks

Consumer Sentiment Index Drops for the First Time in 6 Months

[Asia Economy Reporter Kim Min-young] The cooling of housing purchase sentiment is also reflected in key market-related indicators. With the combined effects of tightened loan regulations, fatigue over rising house prices, and tax pressures, buying demand has decreased while cautious observation has intensified. However, experts say that for signs of a slowdown in house price increases to solidify into a trend, these indicators reflecting house price movements need to persist for at least one quarter.

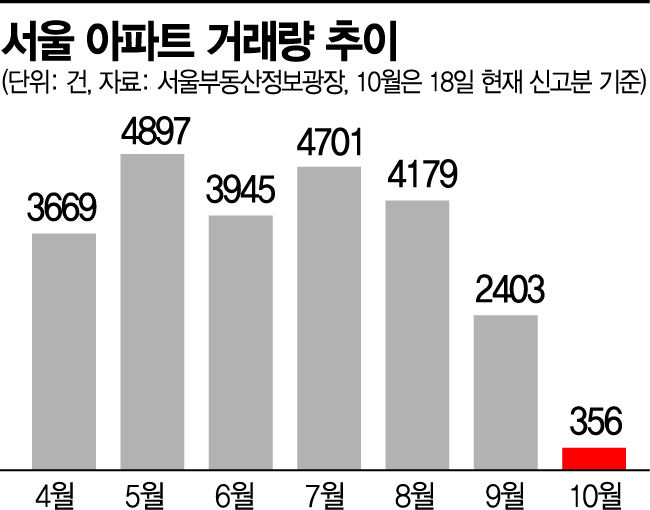

According to the Seoul Real Estate Information Plaza on the 19th, the number of reported apartment transactions in Seoul as of the previous day was 356, a sharp 85% drop compared to the previous month (2,403 transactions). Considering that the reporting deadline for real estate sales transactions is 30 days after the contract date, the transaction volume may increase somewhat, but compared to last month, this is a noticeable decline. Since the beginning of this year, the number of apartment transactions in Seoul averaged between 3,000 and 4,000, but in September it dropped to about half that level and has decreased for three consecutive months.

The decline in transaction volume appears to be influenced by weakened buyer sentiment. More than half of Seoul apartments are high-priced homes exceeding 900 million KRW in market value, and with soaring prices combined with the government's strengthened loan and tax policies, buying demand has cooled. A survey found that 7 out of 10 residents in Seoul and Gyeonggi Province responded that house prices were too high in the first half of this year, making it not the right time to buy, suggesting that potential real buyers are adopting a wait-and-see stance rather than purchasing immediately.

Han Mundo, a professor in the Department of Finance and Real Estate at Yonsei University's Graduate School of Economics and Business, said, "The key is the volume of Seoul apartment transactions, and the decline in transaction volume is becoming prolonged. The housing purchase burden index in the second quarter recorded an all-time high, and this index is directly linked to transaction volume."

In the purchase sentiment index, which can gauge the future housing market, a weakening buying trend is also detected. Last week, the Korea Real Estate Agency's transaction supply-demand index was 101.9, down 0.9 points from the previous week (102.8). This marks a decline for five consecutive weeks since September 6 (107.2). The transaction supply-demand index uses 100 as the baseline; numbers above 100 indicate that demand exceeds supply in the market. The consumer sentiment index for the sales market in Seoul, released by the Land and Housing Institute's Real Estate Market Research Center last month, was 142.8, down 6.1 points from August. This index, which had risen for five consecutive months since March (129.0), has dropped for the first time in six months. The KB Real Estate Live On, a private research institution, announced that this week's Seoul apartment buyer dominance index was 94.5, falling below the baseline of 100 for two consecutive weeks.

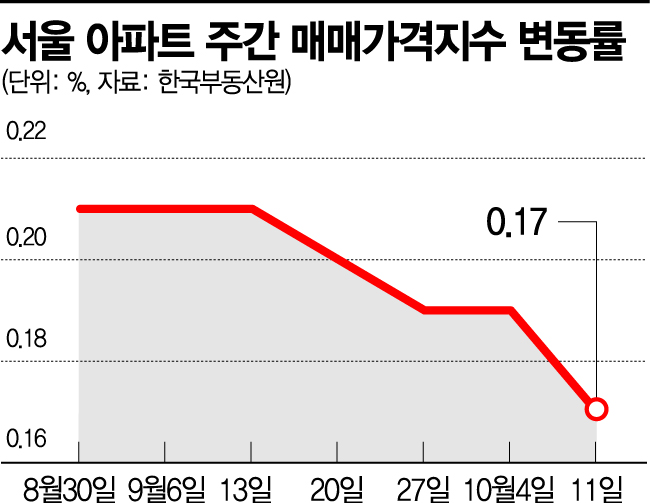

Prices continue to rise, but the rate of increase is narrowing. While new apartments in popular areas of Seoul are setting record prices, the rate of increase in Seoul apartment prices has decreased for seven consecutive weeks. According to the Korea Real Estate Agency, the apartment price increase rate in Seoul slightly fell from 0.21% at the end of August to 0.19% at the end of September, and further dropped to 0.17% as of the 11th of this month. This rate of increase is the lowest in 12 weeks since July 12 (0.15%).

However, experts believe it is too early to declare a turning point based solely on short-term market indicator trends. Although the suspension of loans and tax burdens have weakened buying demand and led to transaction stagnation, it will take at least one quarter of observation to confirm this as a trend.

Ham Young-jin, head of the Zigbang Data Lab, said, "It is difficult to predict market conditions based on short-term trends of one to two weeks. We need to observe various indicators such as transaction volume, prices, and purchase sentiment for one to two quarters before judging a trend reversal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.