Interest Rates Rise Amid Uncertain Stock Market

[Asia Economy Reporter Kwangho Lee] Large sums of money are flowing into bank time deposits. Instead of savings and fixed deposits that lost their appeal due to zero interest rates, market liquidity that had been concentrated in the stock market, real estate, and cryptocurrencies is now "returning" to banks. This is interpreted as the merit of savings and fixed deposits increasing due to the Bank of Korea's base rate hike and the stock market undergoing significant corrections. Additionally, the strengthening of loan regulations, which has blocked "debt investment (debt-financed investing)," is also seen as a factor in the movement of funds. There is a forecast that the "money move" toward safe assets could accelerate due to domestic and international risks such as the Bank of Korea's expected additional rate hikes within the year and the imminent tapering by the U.S. Federal Reserve (Fed).

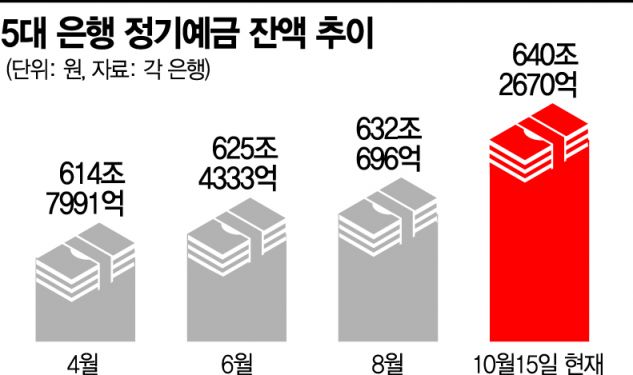

According to the financial sector on the 19th, the balance of time deposits at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?stood at 640.267 trillion won as of the 15th, a sharp increase of 7.8436 trillion won compared to the end of September (632.4234 trillion won). This is the largest increase since May (9.5564 trillion won increase). At this pace of inflow, it is highly likely to exceed 15 trillion won, potentially marking the highest level within the year.

The increase in time deposits is interpreted as a result of growing uncertainty about investments. Due to banks raising interest rates, the relative value of deposits has increased, and with the stock market struggling, more investors are locking their money away. In fact, the demand deposit balance, considered standby funds due to their availability for withdrawal at any time, at the five major banks was 766.2315 trillion won as of the same date, down 8.1611 trillion won from the end of September (774.3926 trillion won).

Experts: "Preference for Safe Assets to Expand Further"

Professor Tae-yoon Sung of Yonsei University's Department of Economics said, "Considering inflation trends and liquidity adjustment phases, interest rates are expected to continue to be adjusted," adding, "In this direction, the preference for safe assets will expand further."

A bank official also stated, "Following the base rate hike in August, another hike in November is likely, which will bring significant changes to the fund market not only through rising loan interest rates but also through rising deposit interest rates."

Experts expect that market liquidity will move to safe assets in conjunction with the interest rate hike period. Professor Jung-geun Oh of Konkuk University's Graduate School of Information and Communication, Department of Financial IT, said, "The Bank of Korea has made the base rate hike a fait accompli, and due to concerns about the Fed's tapering and worsening Chinese economic indicators, it will be difficult to expect returns from risky assets for the time being," adding, "As we enter an era of tightening, the movement of funds to safe assets will occur even faster."

On the other hand, there is also a view that the increase in deposits at commercial banks will be temporary due to the stock, coin, and real estate craze among the 2030 generation and the popularity of intermediary-type ISA accounts. An industry insider said, "The number of subscribers to securities firms' ISA has surpassed that of banks and continues to increase. Especially, the intermediary-type ISA is gaining popularity among the 2030 generation, making the subscriber migration phenomenon more pronounced," adding, "There will be limits to banks increasing deposits by interest rate hikes alone."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)