Different Standards for Similar Services

Concerns Over MyData Impact Next Year

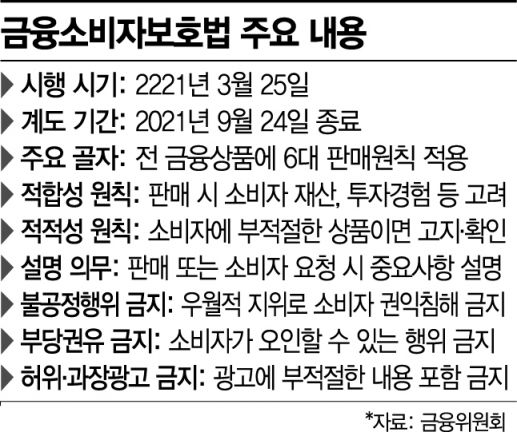

[Asia Economy Reporter Kiho Sung] As financial authorities strengthen the management and supervision of fintech companies under the Financial Consumer Protection Act (FCPA), criticism is being raised over the lack of uniform standards. Whether services are suspended or not varies depending on different criteria applied to similar services. The industry argues that since the service types vary widely across companies and this could also affect the MyData (personal credit information business) project set to be fully implemented next year, establishing concrete standards is urgently needed.

According to the financial sector on the 19th, Kakao Pay stopped its insurance recommendation service on its mobile application (app) starting last month. This action was taken following the financial authorities' judgment that insurance comparison and recommendation services fall under brokerage activities requiring registration under the FCPA. On the other hand, Toss, which operates a similar insurance recommendation service, continues to provide it.

Kakao Pay’s ‘Insurance Solver’ analyzed users’ insurance coverage details. Consultation requests could be made by selecting a preferred time through the ‘My Insurance’ section within the Kakao Pay app, enabling calls with consultants.

Toss’s ‘Toss Insurance Partner’ supports non-face-to-face insurance consultations through a dedicated app used by insurance planners. Although there are some differences in methods, the service content is essentially similar.

The financial authorities state that in Toss’s case, when users click on the insurance recommendation service within the app, they are redirected to the Toss Insurance page, a corporate insurance agency, with a message displayed on the screen saying ‘Moving to Toss Insurance,’ so there is no issue. Regarding subscription benefits, if points or cash rewards are provided by the financial company offering the product rather than the platform operator, it is not problematic. In other words, as long as there is no possibility of consumer misunderstanding, operating insurance recommendation services within the Toss app is permitted.

The problem is that whether the FCPA is violated is determined by the financial authorities’ ‘comprehensive judgment,’ not just the wording. A financial industry insider said, “There is virtually no significant difference between Kakao Pay’s and Toss’s insurance recommendation services,” adding, “Because ambiguous judgments lead to one side stopping the service while the other continues, clearer and uniform standards are necessary.”

Another issue pointed out is that the FCPA-related restructuring may confuse consumers who have been using the services. Instead of a simple ‘one-platform’ recommendation service, consumers must go through double or triple verification steps before subscribing to a product. Additionally, only companies with insurance subsidiaries like Kakao Pay or Toss can offer insurance recommendation services, which has led to criticism that, amid the government’s recent criticism of big tech’s indiscriminate expansion, these companies are effectively being given exclusive business opportunities.

Concerns have also been raised that this could negatively impact the MyData project, which is set to be fully implemented next year. MyData is a business that recommends and develops customized financial products and services based on personal credit information scattered across banks, insurance companies, card companies, government agencies, and hospitals. However, since there is no clear interpretation from financial authorities regarding MyData, the interpretation of brokerage under the FCPA may be applied as is.

An industry insider from the fintech sector said, “According to the FCPA, activities related to the MyData business could be judged as brokerage,” emphasizing, “For fintech companies, this is a matter of life and death, so clear standards regarding brokerage activities must be established first.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.