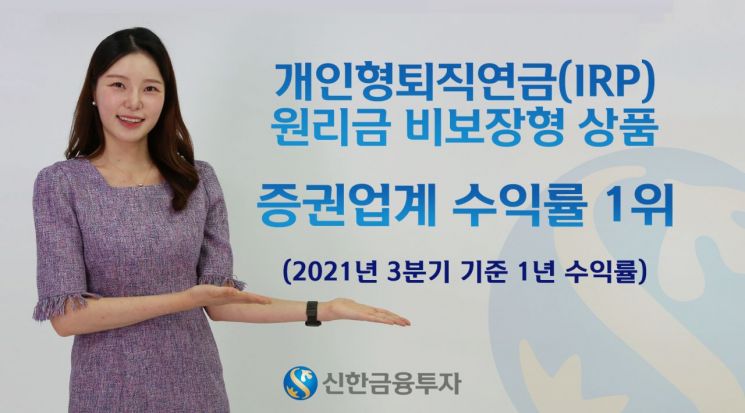

[Asia Economy Reporter Minji Lee] Shinhan Financial Investment announced on the 19th that as of the end of the third quarter, the one-year return rate of non-principal-guaranteed products in Individual Retirement Pension (IRP) was 15.29%, the highest among securities industry retirement pension providers.

The Retirement Pension Division of Shinhan Financial Investment collaborates with the IPS (Investment Product & Service) Headquarters to select recommended retirement pension funds monthly and provide portfolios suitable for customers' investment preferences. Shinhan Financial Investment's retirement pension portfolio avoids including only short-term promising products or principal-guaranteed products and approaches from a long-term investment perspective considering volatility and returns by including funds, ETFs, and REITs to improve customer returns.

Additionally, the dedicated retirement pension consulting team provides recent market conditions and recommended products through card news, helping customers improve their financial indices.

Shinhan Financial Investment exempts both management fees and asset management fees for customers who subscribe to individual IRP non-face-to-face and offers a mobile web service that allows easy and convenient access to retirement pension asset inquiries and financial product transactions without installing an app, enabling convenient management of customers' pension assets.

As a result of these efforts, the proportion of non-principal-guaranteed accumulated funds among Individual Retirement Pension (IRP) customers increased by 8.91 percentage points from 35.68% last year to 44.59% this year.

Park Sung-jin, Head of the Retirement Pension Business Division at Shinhan Financial Investment, stated, “Our goal is to focus on managing returns for customers' valuable retirement pension assets and to continuously expand retirement pension products and content to help customers manage their retirement funds from a long-term perspective.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)