China's Q3 Economic Growth Rate at 4.9%, Falling Short of Initial 5%+ Expectations

Amid Power Shortages and Other Challenges, Chinese Authorities Cite "Reasonable Range"

[Asia Economy Beijing=Special Correspondent Jo Young-shin] China's third-quarter economic growth rate has fallen to the 4% range.

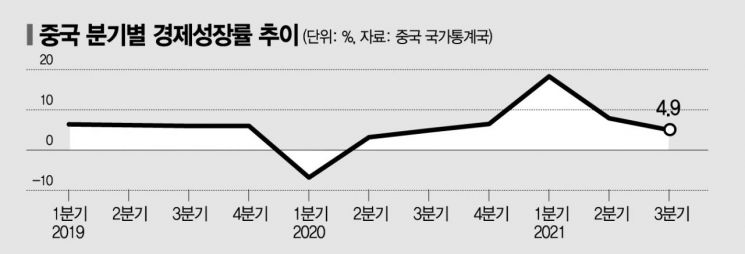

China's National Bureau of Statistics announced on the 18th that the third-quarter gross domestic product (GDP) growth rate was 4.9%. Market forecasts ranged from 5.0% to 5.2%. The dominant view was that China's economy would grow in the 5% range in the third quarter as the base effect diminished. China's economic growth rates were 18.3% and 7.9% in the first and second quarters respectively, but analysis shows that growth momentum is rapidly declining in the third quarter.

◆ China’s growth rate slows for two consecutive quarters = The slowdown in China's economic growth was anticipated. In the first quarter of last year, China's economic growth rate was minus (-) 6.8%. Due to the impact of COVID-19, China's economy experienced an unprecedented plunge. The economy quickly rebounded with a 3.2% growth, achieving a 'V-shaped' recovery, and grew 4.9% and 6.5% in the third and fourth quarters respectively. Because of this, it was expected that China's economy would show a 'high in the first half, low in the second half' pattern this year. However, there are analyses suggesting that China's economic momentum may be declining too quickly. Additionally, external factors such as power shortages and rising international raw material prices are gaining credibility as factors that could hamper China's economy. Since power rationing due to coal stock shortages began in earnest after mid-September, it is expected to have a considerable impact on the fourth-quarter economic growth rate.

◆ The problem of the fourth quarter without base effects = The problem lies in the fourth quarter, when the base effect completely disappears. Moreover, unexpected adverse factors such as ▲manufacturing slowdown due to power shortages ▲rising international raw material prices ▲global logistics system bottlenecks ▲consumption that is slow to recover ▲autumn floods are likely to further accelerate the decline in growth momentum.

Already ominous signs have been detected in major Chinese economic indicators. The Producer Price Index (PPI) in September rose by as much as 10.7% year-on-year. A sharp rise in the PPI means an increase in production costs and implies a deterioration in the profitability of Chinese manufacturing. The September Manufacturing Purchasing Managers' Index (PMI), which provides a glimpse into China's future economy, stood at 49.6. Falling below the baseline (50) is the first time since February last year when COVID-19 was rampant.

Analysts widely agree that rising raw material prices and power rationing due to power shortages are likely to negatively affect China's fourth-quarter economic growth rate. In fact, Goldman Sachs lowered its forecast for China's economic growth rate this year from 8.2% to 7.8%, Nomura Securities Japan from 8.2% to 7.7%, and Fitch from 8.5% to 8.1%. Domestic consumption is also struggling to revive. Tourism revenue during the National Day holiday (October 1?7), the biggest consumption period in China, fell by 65.27 billion yuan (approximately 12 trillion won) compared to the previous year, totaling 389.06 billion yuan. Although the Singles' Day (November 11) remains, the overall situation, including the contraction of the real estate market, is unfavorable.

◆ China is considering growth measures for the fourth quarter = Some speculate that the Chinese government may take policy measures such as lowering the Loan Prime Rate (LPR) and the reserve requirement ratio (RRR). The LPR has been frozen for 17 months, and the RRR was cut once in July.

Inside China, the prevailing view is that Premier Li Keqiang's goal of achieving an economic growth rate of '6% or higher' this year, announced at the beginning of the year, is not in serious jeopardy.

However, if the fourth-quarter economic growth rate is significantly damaged, the repercussions could extend into next year, making it likely that various policy tools will be employed.

There is also some analysis that China has begun to slow down. The Chinese leadership has stated that during the 14th Five-Year Plan period (2021?2025), the focus will be on stable and sustainable growth rather than high-speed growth. The leadership set this year's economic growth target at 6% or higher, about 2 percentage points lower than forecasts from major overseas economic institutions.

◆ Chinese authorities remain optimistic = When releasing the economic growth rate on the day, China's National Bureau of Statistics emphasized that "all macroeconomic indicators in China continue to recover and develop within a reasonable range." It explained that the provisional GDP for the first to third quarters was 82.3131 trillion yuan (approximately 1,516.8 trillion won), an increase of 9.8% compared to the same period last year. By sector, the primary industry was 5.143 trillion yuan, the secondary industry 32.094 trillion yuan, and the tertiary industry 45.0761 trillion yuan.

Industrial production in September, also announced that day, increased by 3.1% year-on-year. This was lower than the market expectation of 4.5%. Power shortages and global logistics system bottlenecks appear to have influenced this.

The National Bureau of Statistics also emphasized that employment indicators are stable. The urban unemployment rate last month was 4.9%, down 0.2 percentage points from the previous month. Compared to the same period last year, it was 0.5 percentage points lower. China's urban unemployment rate target for this year is around 5.5%. Up to the third quarter, the number of new urban jobs reached 10.45 million, achieving 95% of the annual target.

The National Bureau of Statistics also reported that per capita income increased this year. Up to the third quarter, the nationwide per capita disposable income was 26,265 yuan, a nominal increase of 10.4% compared to the same period last year. Urban household per capita disposable income was 35,946 yuan, a nominal increase of 9.5%, and rural household per capita disposable income was 13,726 yuan, an increase of 11.6% compared to the same period last year.

The National Bureau of Statistics stated that China's economy is showing stable growth across all sectors including agriculture, manufacturing, services, employment, exports and imports, and fixed asset investment, but cautioned that attention is needed due to uncertainties in the overseas environment and instability in domestic economic recovery.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.