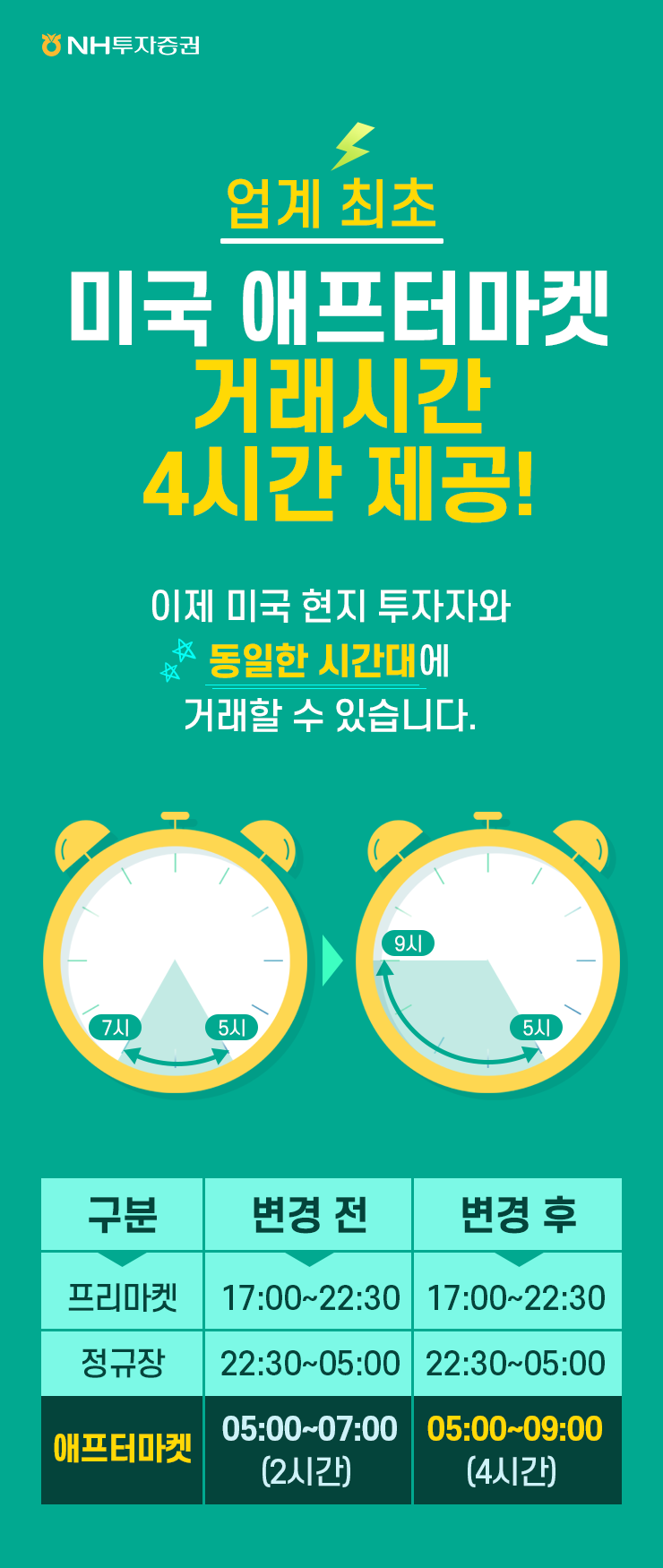

[Asia Economy Reporter Lee Seon-ae] NH Investment & Securities announced on the 18th that it will extend the after-market trading hours for U.S. stocks by 2 hours, from 7 a.m. to 9 a.m. U.S. time, starting October 18.

This is the first time a domestic securities firm is offering a total of 4 hours of after-market trading hours. Based on daylight saving time, NH Investment & Securities is the only domestic securities firm that allows trading for a total of 16 hours, the longest in the industry, with pre-market (17:00?22:30), regular market (22:30?05:00), and after-market (05:00?09:00) sessions. Customers trading overseas stocks through NH Investment & Securities can invest in the same time zone as local U.S. investors.

With the after-market trading hours extended until 9 a.m. (from November 7, when daylight saving time ends, trading will be available from 6 a.m. to 10 a.m.), U.S. stock investors can trade during their commute. In particular, as the earnings season for U.S. companies approaches, major companies such as Tesla, Netflix, Apple, and Microsoft are scheduled to announce earnings after the regular market closes during the after-market hours, enabling investors to respond quickly after checking earnings announcements.

To commemorate the industry's first extension of after-market trading hours, NH Investment & Securities has prepared various events. On the mobile securities app Namu, 1,000 customers will be selected by lottery to receive three types of monthly dividend portfolio stocks that pay dividends every month when trading in the after-market, and on QV, all after-market trading customers will receive a Starbucks Americano gifticon.

Kim Kyung-ho, head of NH Investment & Securities WM Division, said, “The number of customers trading overseas stocks at NH Investment & Securities has increased by 190% compared to the end of last year,” adding, “As the number of overseas stock trading customers has increased, we have focused on customer-centered service improvements to eliminate inconveniences customers feel when investing overseas. In particular, through efforts to eliminate inconveniences caused by time differences, including strengthening new IT infrastructure and investing in overseas stock infrastructure and making groundbreaking improvements, we were able to extend after-market trading hours until 9 a.m.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)