[Asia Economy Reporter Suyeon Woo] As Chinese consumers increase spending not only on oral health but also on oral care for a beautiful smile, there is a call for Korean companies to actively enter the Chinese oral healthcare industry market.

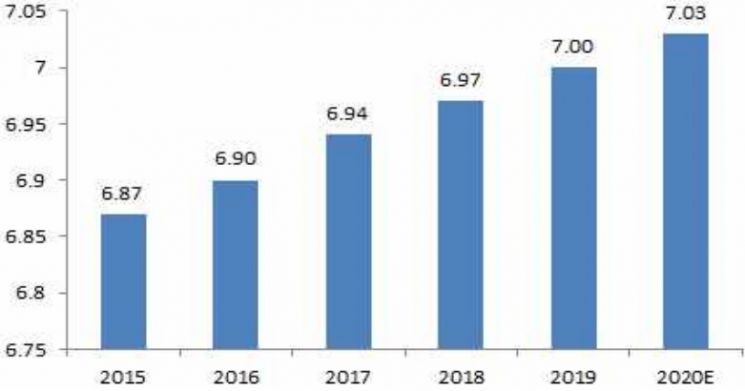

According to the 'Current Status and Implications of the Development of China's Oral Healthcare Industry' published on the 18th by the Korea Trade-Investment Promotion Agency (KOTRA) Chengdu Branch, the number of patients suffering from oral-related problems in China reached approximately 730 million in 2020, and oral issues ranked as the sixth most concerning health problem among Chinese people. The most common treatment received by patients was scaling for cavity prevention at 62%, followed by orthodontics (47%) and teeth whitening (36%), indicating that treatments aimed at improving appearance also constitute a significant portion.

Number of Oral Health Patients in China from 2015 to 2020 (Unit: 100 million)

Number of Oral Health Patients in China from 2015 to 2020 (Unit: 100 million)(Data = China Health Statistics Yearbook)

Last year, the Chinese orthodontic treatment market size recorded 27.6 billion yuan (approximately 5.328 trillion KRW), a 16% increase compared to the previous year, and recently, the market for removable clear aligners has been rapidly growing. While the global clear aligner market shrank by 5.4% last year, China’s market grew by 7.1% to reach 1.5 billion yuan.

The report evaluated that "Considering that the population undergoing orthodontic treatment in China has increased by more than 10% annually since 2014 and that clear aligners have advantages in appearance, comfort, and hygiene, the growth potential of the clear aligner market is very high," forecasting promising prospects for Korean products entering the Chinese market.

Korean brands have also shown remarkable performance in the Chinese implant market. In 2016, Korean brands held a 36% market share by revenue in the Chinese implant market, slightly ahead of European brands at 30%. However, leveraging high cost-effectiveness, Korean brands captured more than half of the market, 58%, within just four years. Meanwhile, the market share of European brands dropped to 22%.

Go Beom-seo, head of KOTRA Chengdu Branch, said, "Only 36% of adults in China brush their teeth more than twice a day, resulting in many people suffering from cavities, and the Chinese government is paying great attention to improving the oral health of its citizens." He added, "As Chinese consumers are significantly increasing spending not only on oral health but also on aesthetic aspects, the market is considered promising for Korean companies to enter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.