[Asia Economy Reporter Minji Lee] As JP Morgan posted earnings that exceeded market expectations for the third quarter, there are forecasts that long-term improvements in NIM (Net Interest Margin) will lead to better performance.

According to the financial investment industry on the 17th, JP Morgan Chase's stock price rose 5.66% from $157.68 to $166.61 as of the 15th. This is analyzed as a significant improvement in investor sentiment reflecting expectations of strong earnings.

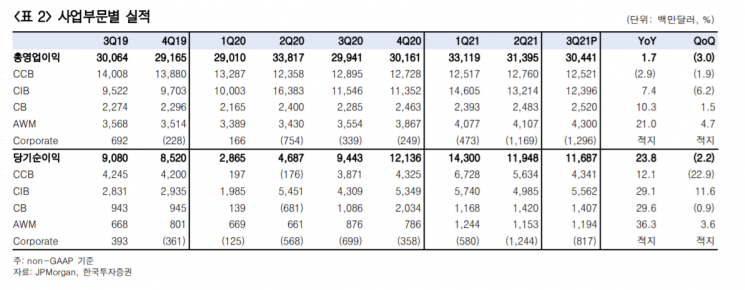

JP Morgan Chase recorded operating revenue of $30.4 billion, a 2% increase compared to the same period last year. EPS was $3.74, growing 28% over the same period, surpassing market expectations. Net operating revenue increased by 1% year-over-year to $29.6 billion.

Net interest income (NIM) was 1.62%, down 20 basis points year-over-year due to continued loan growth slowdown but remained the same as the previous quarter. Baek Doosan, a researcher at Korea Investment & Securities, said, “The decline in NIM stopped for the first time since COVID-19. Considering that NIM was 2.4% in Q4 2019 and the direction of monetary policy, there is ample room for NIM to rise in the future,” adding, “Given that the average loan balance growth rate in Q3 was 5%, indicating healthy loan demand, interest income is expected to be favorable.”

By segment, Consumer & Community Banking (CCB) net income decreased 2.9% year-over-year to $12.52 billion. Despite increases in deposits and investment assets, this was affected by declines in mortgage servicing and card revenue. Corporate & Investment Bank (CIB) net income rose 7% to $12.4 billion, reflecting a 45% increase in IB revenue centered on mergers and acquisitions (M&A) advisory and initial public offerings (IPO), as well as a 30% increase in equity market revenue due to increased trading activity. Commercial Banking (CB) net income grew 10% to $2.5 billion, supported by strength in IB and wholesale. Asset & Wealth Management (AWM) net income increased 21% to $4.3 billion, driven by growth in assets under management (AUM).

The annual guidance for net interest income remains at $52.5 billion, and expected expenses are maintained at $71 billion. The company positively highlighted expectations for loan growth stabilization as credit and debit card spending increase, and competitiveness is being strengthened through M&A. Long-term performance recovery is also anticipated due to NIM improvement. Choi Bowon, a researcher at Hanwha Investment & Securities, explained, “Continuous dividend payments and share buybacks enhance shareholder returns, and further profit growth is expected with economic recovery,” adding, “The benefit from rising interest rates expected through next year is also positive.”

Stable asset quality is expected to support improved performance next year. Although $15.7 billion in reserves was set aside in the first half of last year based on future economic outlooks, $13.8 billion has been reversed cumulatively from Q3 last year through this quarter as performance forecasts improved. After additional reversals next quarter, a normalized reserve flow is expected from Q1 next year. Researcher Baek Doosan said, “Once reserves normalize, asset quality is expected to be better than before COVID-19,” and added, “Strong performance will continue next year, centered on interest income and improvements in normal asset quality indicators.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.