[Asia Economy Reporter Ji-hwan Park] In the first half of this year, individual investors suffered losses of 277 billion KRW through overseas product trading, while institutions recorded profits exceeding 1 trillion KRW.

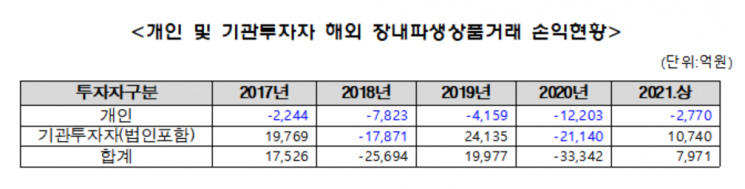

On the 17th, according to the 'Status of Domestic Investors' Overseas Exchange-Traded Derivatives Trading Profit and Loss' submitted by the Financial Supervisory Service to Kim Byung-wook, a member of the Democratic Party of Korea, domestic individual investors have been experiencing losses for five consecutive years since 2017 by investing in overseas derivatives. The profit and loss of individual investors in overseas derivatives showed -224.4 billion KRW in 2017, -782.3 billion KRW in 2018, and -415.9 billion KRW in 2019, with losses sharply increasing to 1.2203 trillion KRW last year. This year, losses of 277 billion KRW were recorded in the first half alone.

On the other hand, institutional investors posted profits and losses of 1.9769 trillion KRW in 2017, -1.7871 trillion KRW in 2018, 2.4135 trillion KRW in 2019, and -2.114 trillion KRW in 2020 during the same period. Notably, this year, they earned profits of 1.074 trillion KRW up to the first half.

Derivatives are financial products whose prices are determined by changes in the value of underlying assets. Various underlying assets such as stocks, bonds, oil, currencies, and stock indices are traded. Among these, overseas derivatives refer to investment products including overseas futures and overseas options. They trade index or commodity futures products registered on major exchanges worldwide. In the case of futures, contracts are made by predicting the rise or fall of index or commodity prices in advance. Overseas futures and options are characterized by high trading volumes and volatility, making them ultra-high-risk products with structures that can easily yield profits or losses in a short period.

Domestic individual investors' overseas derivatives trading has been increasing every year. From 216.8 trillion KRW in 2017, the trading volume surged more than threefold to 658 trillion KRW last year compared to 2017.

In contrast, domestic derivatives trading fluctuated between 246.8 trillion KRW during the same period and only increased 1.6 times to 412.6 trillion KRW last year. It is analyzed that the spread of COVID-19 increased volatility, prompting investors to look overseas as an alternative to improve returns.

Since derivatives are highly volatile and difficult to predict, they are classified as ultra-high-risk products. Therefore, individual investors trading in the domestic derivatives market are required to undergo prior education and simulated trading, and a basic deposit system is also in place.

Assemblyman Kim Byung-wook stated, "Overseas futures and options are ultra-high-risk products with significant risk and volatility, and it is important to note that losses exceeding the principal are possible. As direct overseas derivatives investment by individual investors is rapidly increasing and losses continue, risk management such as prior education on derivatives is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)