COFIX at 1.16% Based on New Handling Amount

[Asia Economy Reporter Kiho Sung] The COFIX (Cost of Funds Index), which banks use as a benchmark to calculate variable-rate mortgage loan interest rates, has risen by 0.14 percentage points in just one month. Accordingly, mortgage loan interest rates are expected to increase starting tomorrow.

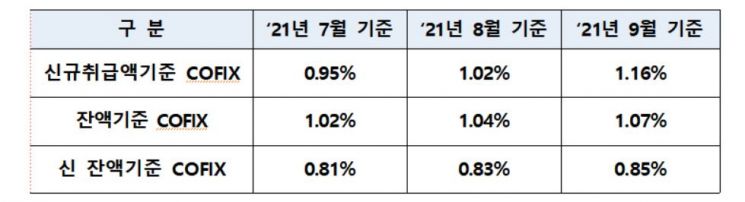

According to the Korea Federation of Banks on the 15th, the COFIX based on new loan amounts in September was 1.16%, up 0.14 percentage points from the previous month. The COFIX based on new loan amounts has been on a continuous upward trend since February this year (0.83%).

The COFIX based on outstanding loan balances and the new outstanding loan balance-based COFIX also increased. In September alone, the balance-based COFIX rose 0.03 percentage points to 1.07% compared to the previous month, and the new balance-based COFIX (as of the end of September) recorded 0.85%, up 0.02 percentage points from the previous month.

Accordingly, banks will uniformly raise variable-rate mortgage loan interest rates starting from the 16th. Kookmin Bank will operate mortgage loan interest rates linked to the COFIX based on new loan amounts at an annual rate of 3.47% to 4.67% starting on the 16th. Woori Bank will raise the interest rates for the same product by 0.14 percentage points from 3.0%?3.71% to 3.14%?3.85% starting on the 18th.

COFIX refers to the weighted average interest rate of funds raised by eight domestic banks, including NH Nonghyup, Shinhan, Woori, SC Jeil, Hana, Industrial Bank of Korea, KB Kookmin, and Citibank Korea.

Products subject to COFIX include time deposits, installment savings, mutual installment savings, housing installment savings, negotiable certificates of deposit, repurchase agreement sales, commercial paper sales, and financial bonds (excluding subordinated bonds and convertible bonds). The new balance-based COFIX additionally includes other deposits, other borrowings, and settlement funds. When banks raise or lower interest rates on deposit products such as actual deposits, installment savings, and bank bonds, these changes are reflected in COFIX, causing it to rise or fall accordingly.

The Korea Federation of Banks explained, "The balance-based COFIX and new balance-based COFIX generally reflect market interest rate changes gradually, but the COFIX based on new loan amounts is calculated based on funds newly raised during the month, so it tends to reflect market interest rate changes more quickly. Therefore, those seeking COFIX-linked loans need to fully understand these characteristics of COFIX and carefully select loan products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.