[Asia Economy Reporter Ji Yeon-jin] Concerns about stagflation are growing as raw material prices soar due to global energy supply worries. The financial investment industry analyzes that while inflation concerns in the U.S. are likely to continue until next year and economic recovery is delayed due to supply chain disruptions, the possibility of stagflation is limited.

According to the financial investment industry on the 17th, the price of West Texas Intermediate (WTI) crude oil has surged above $80 per barrel since the 11th, reaching its highest level since 2014.

Natural gas prices have also surged. Europe is facing an energy crisis as abnormal weather has reduced wind power generation, and natural gas supply cannot keep up with demand. China and India, where coal power generation accounts for a high proportion, are suffering from severe power shortages as coal inventories have sharply declined.

The energy supply shortage that began with natural gas and coal is driving a simultaneous rise in oil prices. This is because when energy source inventories are insufficient, demand for crude oil as an alternative energy source increases.

OPEC+ maintains a passive stance on production increases, and OECD crude oil inventories have fallen to pre-crisis levels, resulting in demand exceeding supply for crude oil as well. The upward trend in energy prices is expected to continue for the time being, potentially increasing inflationary pressures.

Wage pressure in the labor market is also a factor driving inflation. As economic recovery begins, labor demand from U.S. companies has rapidly rebounded, but workers’ return to the labor market has been delayed, causing a persistent labor shortage. The number of job openings in the U.S. nonfarm sector is approaching an all-time high, and the voluntary quit rate, reflecting workers’ confidence, is also on the rise. Analysts say that the supply-demand imbalance in the labor market has intensified, increasing wage pressure.

The average hourly wage in the U.S. in September rose 4.6% year-on-year, with wages increasing in both manufacturing and service sectors. Since wages are difficult to reduce once they rise, rising labor costs pose a burden on companies. The U.S. consumer price index in September rose 5.4% year-on-year, exceeding the consensus forecast of 5.3%. This marks a return to the levels seen in June and July, the highest since 2008.

Considering supply chain disruptions, surging energy prices, and wage pressures, inflation concerns in the U.S. are expected to continue until next year.

Although economic recovery is delayed due to these supply chain disruptions, the possibility of stagflation is not high. Stagflation is a phenomenon where prices rise sharply during an economic recession; during the representative stagflation of the 1970s oil crisis, oil prices surged and U.S. consumer prices rose by 12%.

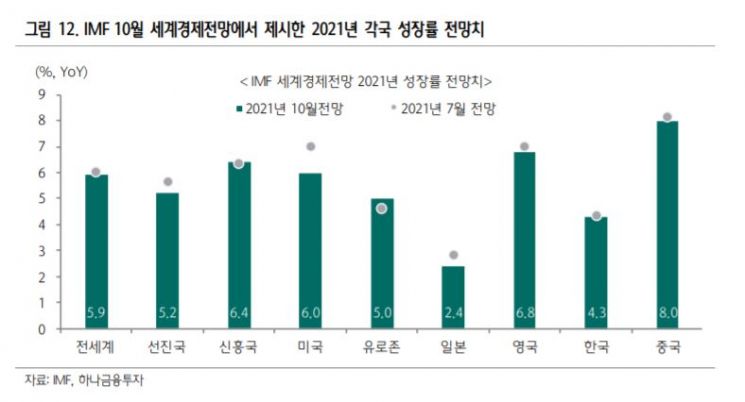

Currently, although global economic growth has somewhat weakened, the likelihood of entering a recession phase is low. The International Monetary Fund (IMF) lowered its global economic growth forecast for this year to 5.9% in its October economic outlook, citing supply disruptions and the resurgence of COVID-19, but the downward revision was only -0.1 percentage points. Kyu-yeon Jeon, a researcher at Hana Financial Investment, said, "Global demand remains robust. The inventory-to-sales ratio in the U.S., which shows inventory relative to sales, is near an all-time low, so economic recovery is delayed more due to widespread supply chain disruptions than demand. If demand supports it, the trend of global economic recovery remains valid."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.