Sharp Surge in Crude Oil and Natural Gas Prices Drives MOEX Russia Index to Strong Gains... Ruble Hits Highest Level Since July Last Year

[Asia Economy Reporter Park Byung-hee] The Russian stock market, a powerhouse in energy, hit an all-time high on the 14th (local time), and the value of the Russian ruble soared to its highest level since July last year. This is due to the recent sharp rise in prices of Russia's major export commodities, crude oil and natural gas. The price of natural gas in Europe, a key export region for Russian natural gas, has increased more than fivefold this year, and international crude oil prices are at their highest in seven years.

Russia is the world's largest exporter of natural gas and the third-largest exporter of crude oil. As of 2020, the share of crude oil and gas exports accounted for 49.7% of Russia's total exports, and the oil and gas industry made up 9.4% of Russia's gross domestic product (GDP).

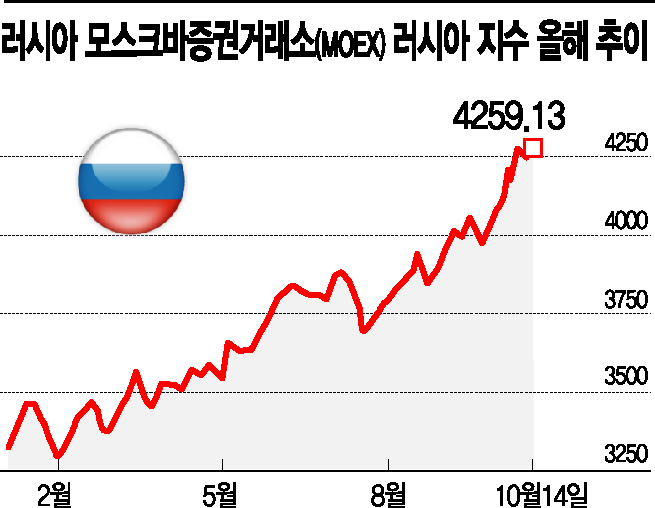

Supported by the rising energy prices, the Russian stock market has shown a strong upward trend since the beginning of this year.

According to major foreign media, the Moscow Exchange (MOEX) Russia Index, calculated in rubles, surged 1.6% intraday to 4292.68, breaking its all-time high. However, it trimmed gains toward the end of the session and closed up 0.4% at 4259.13. The Russia Index has risen 29.5% this year.

The RTS Index, calculated in US dollars, also closed up 1.1% at 1875.97, increasing its year-to-date gain to 35.2%.

While emerging markets have struggled this year due to differences in vaccination rates between developed and emerging countries, the Russian stock market has recorded outstanding returns. The Shanghai Composite Index in China has risen only 2.5% this year, and Brazil's Bovespa Index, which suffered from the spread of COVID-19, has fallen 4.9% this year.

The ruble is also on the rise. On the afternoon of the same day, the Russian ruble rose about 0.6% against the dollar, with the dollar-ruble exchange rate at 71.54 rubles per dollar. This is the highest ruble value since late July last year, when the rate was 71.52 rubles per dollar. Russia's Sberbank CIB expects the ruble to remain strong next year due to rising natural gas prices, forecasting the average dollar-ruble exchange rate next year at 68.3 rubles per dollar.

The possibility of the Russian central bank raising its benchmark interest rate is also fueling the ruble's strength. Market participants expect the central bank to raise the current benchmark rate of 6.75% to at least 7% at the monetary policy meeting on the 22nd. This is because Russia's consumer price inflation rate in September reached 7.63%, the highest since February 2016.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.