Foreigners' Departure Accelerates with -5.0% Recorded

Decline Greater Than Crisis Epicenter China

Experts Say "Technical Rebound Possible After Sharp Drop"

KOSPI Starts Today on an Uptrend

[Asia Economy Reporter Song Hwajeong] Amid the global stock markets showing a simultaneous downturn this month due to China's Evergrande crisis and the US interest rate hike issue, the Korean stock market experienced the steepest decline, performing particularly worse than others. The outflow of foreign investors accelerated, resulting in a larger drop compared to Japan, where economic policy risks emerged due to a prime minister change, and China, one of the epicenters of the global crisis.

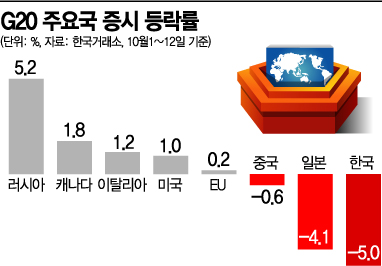

According to the Korea Exchange on the 14th, a comparison of stock market fluctuations among the Group of 20 (G20) countries from the beginning of this month to the 12th showed that Korea recorded a -5.0% decline, the largest drop. Among the 20 countries, five recorded negative returns: Korea, China (-0.6%), Australia (-0.7%), Germany (-0.7%), and Japan (-4.1%).

On the other hand, Russia showed the largest increase at 5.2%, followed by Indonesia (3.2%), South Africa (2.7%), India (2.0%), and Canada (1.8%). The US stock market rose by 1.0%.

While all major Asian countries showed weakness, Korea's decline was particularly pronounced. China faced various regulatory issues compounded by the Evergrande crisis, and Japan experienced negative impacts on stock prices due to skepticism about economic policies following Prime Minister Fumio Kishida's inauguration, but both declined less than Korea.

Korea recorded a larger decline than these countries due to foreign investor outflows caused by inflation concerns, negative factors from China, semiconductor sluggishness, and a strong dollar, as well as a weakening of individual buying power that had supported the stock market. Kim Yonggu, a researcher at Samsung Securities, analyzed, "A series of external adverse factors were compounded by internal discord within the domestic stock market," adding, "In particular, China is generating sudden negative factors such as regulatory risks, the Evergrande crisis, power shortages, worsening cross-strait relations, and the reignition of US-China trade friction risks, which are tightening the fundamentals of emerging market stocks overall. Korea is also facing additional internal negative factors such as earnings momentum peak-out and concerns over individual investor demand."

However, there are also voices predicting a technical rebound due to the recent sharp drop. Lee Kyungmin, a researcher at Daishin Securities, said, "The KOSPI 2900 level corresponds to a 12-month forward price-to-earnings ratio (PER) of about 10 times, and the price and valuation attractiveness following the recent sharp decline in the KOSPI could lead to a technical rebound."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.