Order unit price $170 million... 3 times higher than China

Focusing on 'quality over quantity' through securing order volume

[Asia Economy Reporter Hwang Yoon-joo] The Korean shipbuilding industry lost its top spot in ship orders to China in September. This is interpreted as a strategy to secure construction volumes through 2024 amid a boom in orders, focusing on high value-added vessels.

According to Clarkson Research, a UK-based shipbuilding and shipping market analysis firm, global ship orders in September totaled 3.28 million CGT (116 vessels), with Korea securing 910,000 CGT (14 vessels, 28%), ranking second. China took first place with 1.95 million CGT (75 vessels, 60%), and Japan maintained third place with 260,000 CGT (15 vessels, 8%).

The data suggests a focus on quality over quantity. The order price per vessel in September was about $170 million for Korea, more than three times higher than China’s $60 million.

Year-to-date global orders reached 37.54 million CGT, a 184% increase compared to the same period last year. Compared to 2016, a downturn year for shipbuilding (10.53 million CGT), this represents approximately a 3.6-fold increase.

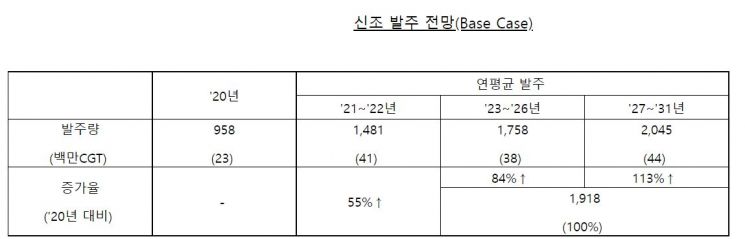

According to the Clarkson Research report, due to the International Maritime Organization (IMO)’s strengthened environmental regulations, demand for eco-friendly ships is increasing. From 2023 to 2031, the average annual order volume is expected to reach 42 million CGT, double that of 2020. The share of eco-friendly ship orders is projected to rise from 32% this year to 59% in 2030 and 100% by 2050, raising expectations for the advancement of Korean shipyards, which possess technological competitiveness in the eco-friendly ship sector.

As of last month, the global order backlog increased by 990,000 CGT compared to the end of August, reaching 87.63 million CGT. By country, the order backlog stood at China (35.37 million CGT, 40%), followed by Korea (28.56 million CGT, 33%) and Japan (9.4 million CGT, 11%).

The Clarkson Newbuilding Price Index rose 3 points from the previous month to 149.1 points, continuing its upward trend.

By vessel type, the prices were as follows: Very Large Crude Carriers (VLCC) at $107 million, S-max tankers at $74 million, A-max tankers at $59 million, and 13,000?14,000 TEU container ships (1 TEU equals one 20-foot container) at $143.5 million, with all vessel types showing increases. Notably, liquefied natural gas (LNG) carriers reached $202 million, surpassing $200 million for the first time in five years since 2016.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.