No Choice Despite Reckless Lawsuit Stigma

727 Unjust Enrichment Recovery Lawsuits in First Half

Urgent Need to Establish Institutional Recovery Measures

[Asia Economy Reporter Oh Hyung-gil] Even when found guilty of insurance fraud, the unjust gains obtained through fraud are not fully returned. Despite the stigma of aggressively filing lawsuits against consumers, insurance companies have no choice but to pursue unjust enrichment recovery lawsuits. Although the scale of insurance fraud detection has been increasing every year, there are calls for institutional measures to be established for recovery after detection.

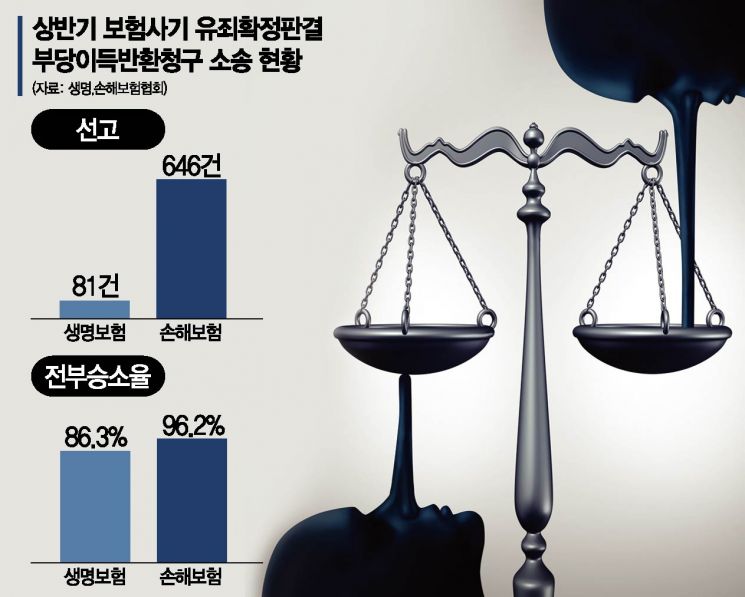

According to the insurance industry on the 13th, in the first half of this year, there were a total of 727 insurance fraud unjust enrichment recovery lawsuits, including 81 cases in life insurance and 646 cases in non-life insurance. Among these, the average full victory rate for life insurers was 86.3%, while non-life insurers recorded 96.2%.

Among life insurers, ABL Life had 2 lawsuits, winning fully in 1 case but losing 1, resulting in a 50% victory rate. Dongyang Life also recorded a 50% full victory rate with 1 full win and 1 partial win/loss out of 2 cases. Heungkuk Life (80%) and Fubon Hyundai Life (85.7%) also showed low full victory rates.

Among major companies, Hanwha Life recorded 6 full wins, 1 partial win/loss, and 3 losses out of 10 lawsuits. Samsung Life won fully in 14 out of 15 lawsuits, with 1 partial win/loss. Kyobo Life had 9 full wins and 1 partial win/loss out of 10 cases. Shinhan Life, NH Nonghyup Life, LINA Life, AIA Life, Orange Life (before merger), DB Life, and MetLife Life each achieved a 100% full victory rate.

Since automobile insurance and indemnity medical insurance are mainly exploited for insurance fraud, non-life insurers have relatively many lawsuits but also high full victory rates. Hyundai Marine & Fire Insurance won fully in all 165 lawsuits in the first half, while Samsung Fire & Marine Insurance recorded 156 full wins out of 160 cases, achieving a 97.5% full victory rate.

On the other hand, Hana Insurance won fully in only 3 out of 4 cases, achieving 75%, while Hanwha General Insurance (92.8%), AXA General Insurance (96.5%), Meritz Fire & Marine Insurance (97.5%), and DB Insurance (99.1%) also did not win all their lawsuits.

Insurance companies file unjust enrichment recovery lawsuits when a guilty verdict for insurance fraud is confirmed to reclaim the insurance payments made due to fraud. Although criminal trials conclude with a guilty verdict for insurance fraud, civil trials must be conducted to recover the insurance money fraudulently obtained by the accused.

This is because the current 'Special Act on the Prevention of Insurance Fraud' does not include provisions for recovering defrauded insurance payments. A revision bill that would require insurers to recover fraud amounts upon a confirmed fraud conviction has been pending in the National Assembly for years.

Insurance companies express difficulties, saying they have no choice but to file lawsuits. Even when lawsuits are filed, there are many cases where the accused hide assets during the litigation process, limiting recovery. Additionally, courts sometimes side with medical institutions, considering that actual medical services were provided, resulting in failure to recover insurance payments.

An insurance industry official said, "There are often different standards of judgment between criminal convictions for insurance fraud and civil trials to recover insurance payments," adding, "While legal judgments can naturally differ, it is a very regrettable aspect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)