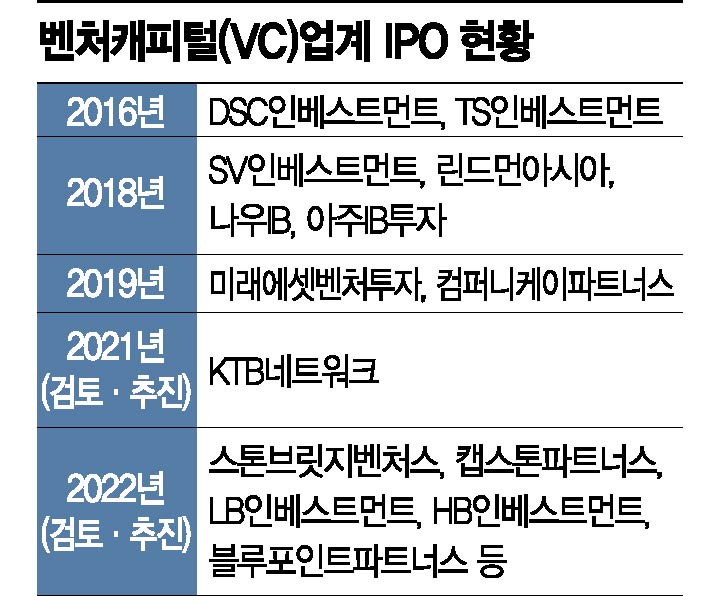

[Asia Economy Reporter Lee Seon-ae] Starting with Stonebridge Ventures, venture capital (VC) firms are expected to flood the market with initial public offerings (IPOs). As market trust in the investment performance of VC firms builds, the venture investment market is enjoying an unprecedented boom, and with the IPO craze, these firms are seizing the opportunity to knock on the stock market's door.

According to the Korea Exchange on the 13th, Stonebridge Ventures submitted a preliminary review application to the KOSDAQ Market Division on the 8th. Established in 2017 as a spin-off from Stonebridge Capital, Stonebridge Ventures is ranked among the top 10 domestic VCs managing about 700 billion KRW. It has invested in companies such as Krafton, Zigbang, Zigzag, StyleShare, Socar, Jeju Beer, Jin System, and Wanted Lab, generating profits. The lead underwriters for the listing are Samsung Securities and KB Securities. If the review proceeds as scheduled, the company plans to enter the KOSDAQ market around the first quarter of next year.

KTB Network, the largest domestic VC managing 1.12 trillion KRW, aims to go public within this year. It submitted a preliminary review application to the KOSDAQ Market Division on August 18. The lead underwriter is Korea Investment & Securities. It has nurtured unicorn companies (startups valued at over 1 trillion KRW) such as Woowa Brothers (Baedal Minjok) and Viva Republica (Toss), generating investment returns.

Capstone Partners aims for an IPO next year. Managing assets of about 200 billion KRW, it specializes in early-stage startups. It has achieved results by investing in companies like Danggeun Market and Market Kurly.

Additionally, Bluepoint Partners, a venture accelerator (providing early investment and mentoring), is expected to challenge the listing again. Bluepoint Partners voluntarily withdrew its KOSDAQ listing last year but plans to proceed with the listing process after increasing market understanding of the accelerator business and enhancing its corporate value. HB Investment and LB Investment are also preparing for IPOs.

A VC industry insider said, "There have been no VC IPOs since Mirae Asset Venture Investment and Company K Partners in 2019. This is because stocks of companies like Now IB, AJU IB Investment, and SV Investment, which went public in the mid-2010s, underperformed below their offering prices, creating a reluctance to list." He added, "With the market conditions improving this year, there is a growing movement to go public, judging that now is the right time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.