[Asia Economy Reporter Ji Yeon-jin] A plan is being promoted to issue asset-backed securities even if a company's credit rating is low, as long as it holds high-quality assets. Asset securitization refers to a series of actions that convert illiquid assets held by financial companies or general enterprises into market-tradable securities and monetize them.

The Financial Services Commission announced that the amendment to the "Asset Securitization Act" containing these details was approved at the Cabinet meeting on the 12th.

Currently, to issue registered securitized securities, a company must have a credit rating of BB or higher, so companies with low or no credit rating cannot utilize the system even if they hold high-quality assets.

This amendment removes such credit rating requirements. Instead, from the perspective of investor protection, the Financial Services Commission plans to set new requirements in subordinate legislation for "corporations subject to external audits that meet certain conditions."

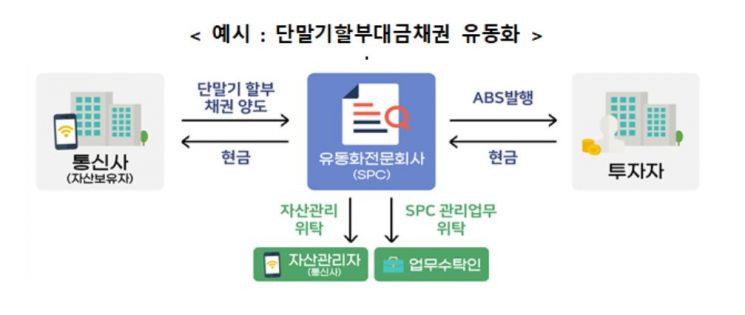

The scope of assets subject to securitization will be expanded to include "claims to be generated in the future" and "intellectual property rights," and multiple asset holders will be able to participate in securitization simultaneously. Accordingly, multi-seller securitization, where a securitization-specialized company (SPC) receives assets from multiple companies and issues securitized securities, will become possible.

The amendment also includes provisions to reduce procedural burdens by relaxing the registration obligation to a discretionary rule when the SPC returns securitized assets to asset holders or establishes a security interest on securitized assets.

Transparency in issuing securitized securities will also be enhanced. Unlike registered securitization, which can apply procedural exceptions under the Asset Securitization Act, non-registered securitization has voluntary disclosure, often resulting in omission of important information or inaccurate disclosures.

The amendment improves the disclosure system to require disclosure of issuance information when issuing securitized securities. The information to be disclosed includes issuance details (issuance amount, maturity, etc.), information on participating institutions (asset holders, actual fund providers, asset managers, etc.), underlying asset information, credit enhancement information, etc., which will be delegated to subordinate regulations.

Additionally, the amendment includes ▲ granting asset manager qualifications for securitized assets with only debt collection permission ▲ expanding incentives for registered securitization ▲ simplifying the registration procedure for asset securitization.

The Financial Services Commission plans to submit the amendment to the Asset Securitization Act to the National Assembly within this month and implement it as early as the first half of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.