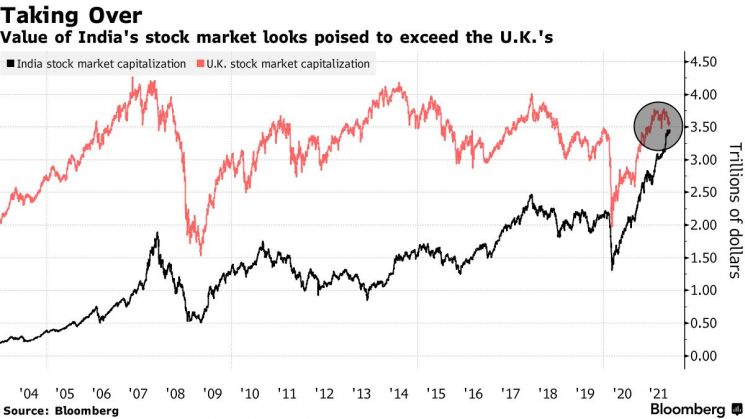

[Asia Economy Reporter Park Byung-hee] Bloomberg reported on the 11th (local time) that the Indian stock market is on the verge of surpassing the United Kingdom in market capitalization size to enter the world's top 5 markets.

This year, the market capitalization of the Indian stock market increased by 37% to $3.46 trillion. With historically low benchmark interest rates and an influx of individual investors, the Indian stock market has been hitting record highs day after day recently. On the other hand, the market capitalization of the UK stock market is around $3.59 trillion, with a growth rate of only 9% this year. If the Indian stock market rises by just 4% more, it can overtake the UK stock market.

India's high economic growth prospects and solid IT industry are driving factors behind the rise in the Indian stock market. IT sector startups continue to be listed on the stock market, injecting vitality into the market. Conversely, the UK stock market faces headwinds from uncertainties following Brexit (the United Kingdom's withdrawal from the European Union), which hinder stock price growth.

The Sensex index of the Mumbai Stock Exchange has risen 130% since March last year. In dollar terms, the average return of the Sensex index over the past five years was 15%, significantly outperforming the UK FTSE 100 index's average return of 6%.

Goldman Sachs expects the market capitalization of the Indian stock market to increase to $5 trillion by 2024. It is anticipated that new initial public offerings (IPOs) over the next 2 to 3 years will increase market capitalization by about $400 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.