Rapid Increase in Household Debt and Inflation

Stabilization Expected Through Interest Rate Hikes

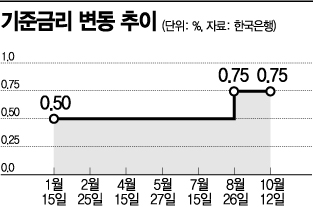

[Asia Economy Reporter Jang Sehee] The Bank of Korea has kept the base interest rate steady at 0.75% per annum. This decision comes as the economic recovery momentum has slowed due to the fourth wave of COVID-19 and increased financial market volatility. However, the market expects the Monetary Policy Committee to raise rates next month to prevent side effects caused by prolonged low interest rates.

The Bank of Korea's Monetary Policy Committee held a meeting on the 12th and decided to maintain the current base rate. Following the meeting, Governor Lee Ju-yeol stated at a press conference, "Since the domestic economy is expected to continue a favorable growth trend and inflation is projected to remain above 2% for the time being, we will appropriately adjust the degree of monetary policy easing going forward." Although the committee paused amid signs of increased stock market and exchange rate volatility, it indicated that it would raise rates once economic recovery becomes more visible next month. The GDP growth rate for this year is expected to be around 4%, as forecasted in August.

The decision to hold the base rate was influenced by weak economic indicators and increased stock market volatility. According to the August industrial activity report, production, consumption, and investment all declined for the first time in three months. The early rate hikes in the U.S. and the Evergrande crisis in China also contributed to heightened financial volatility. Governor Lee noted, "The global economy and international financial markets are expected to be influenced by the extent of COVID-19 resurgence, vaccine distribution status, global inflation trends, and changes in major countries' monetary policies."

On the day of the announcement, the won-dollar exchange rate surpassed the 1,200 won mark, and the stock market opened at 2,950.22 points and showed weakness. Continued won depreciation tends to push up import prices, which in turn affects overall inflation. Professor Lee In-ho of Seoul National University’s Department of Economics said, "Given the current stock market conditions, it is true that raising interest rates is difficult," but added, "If the U.S. begins tapering (asset purchase reduction) in earnest and we do not respond with rate adjustments, the exchange rate could rise further." In such a case, import prices would increase, potentially causing additional inflation.

◆ Rate Hike in November Unavoidable= However, the prevailing view is that the base rate will be raised next month. This is because household debt is rapidly increasing, and inflation and housing prices continue to rise, necessitating stabilization through rate hikes. Scenarios anticipate two 25 basis point rate increases at the Monetary Policy Committee meetings next month and in January or February of next year.

Professor Kim Sang-bong of Hansung University’s Department of Economics explained, "To effectively manage the total volume of household debt, it is necessary to respond with interest rate hikes to curb rapid housing price increases." He added, "Considering the surge in household debt, inflation, and housing prices, rates should be raised next month. If the low interest rate trend continues, in the worst case, even if we issue bonds, there may be no buyers for them," issuing a warning.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)