[Asia Economy Reporter Hwang Junho] In the third quarter of this year, the power outage, manufacturing shutdowns, Evergrande Group and real estate hard landing risks, and the growing stagflation concerns surrounding the Chinese stock market are largely reflected in the market as "outcomes within controlled risks," according to an analysis. Kim Kyunghwan, a researcher in charge of China investment strategy at Hana Financial Investment, analyzed in the weekly outlook for the Chinese stock market on the 11th, "From this month, it is necessary to pay attention to how quickly China's policy resolves issues and short-term reversals raise price and economic bottom expectations.

First, regarding the power shortage, attention should be paid to the State Council executive meeting chaired by Premier Li Keqiang on the 8th. At this meeting, a full-scale coal supply campaign for the next six months (145 million tons supply in Q4), a significant increase in electricity prices (to motivate thermal power generation), and demands for revising uniform production/transmission restrictions by local governments and campaign-style carbon reduction were made. It is difficult to say that 145 million tons can perfectly cover the previous shortages and Q4 demand. However, it is expected not to further worsen the power shortage and the sharp rise in coal prices. Accordingly, on the first trading day after the National Day holiday, the spot price of thermal coal fell sharply by about 9% on the 8th.

If this trend continues, commodity prices (centered on steel/non-ferrous metals/chemicals/building materials), which are dependent variables of coal prices, will turn downward from October, potentially reducing stagflation concerns. The September PPI, to be announced on the 14th, is expected to mark the peak of this cycle, and in the short term, the expectation of the 'PPI spread' (energy/material margin increase) may indicate that it has reached its limit, so it is necessary to monitor this.

Positive signals regarding Evergrande Group's survival have also been detected around the National Day holiday. Just before the National Day holiday, the People's Bank of China and financial authorities suggested adjusting the pace of demand regulation to stabilize real demand and prevent a hard landing. Accordingly, the risk of a technical default may be postponed until after the end of the year due to Evergrande's self-help measures and the possibility of local government intervention expanding. If equity sales materialize, the repayment risk for $700 million in dollar bond interest by the end of the year will decrease, and time will be secured until principal repayment in the second quarter of next year.

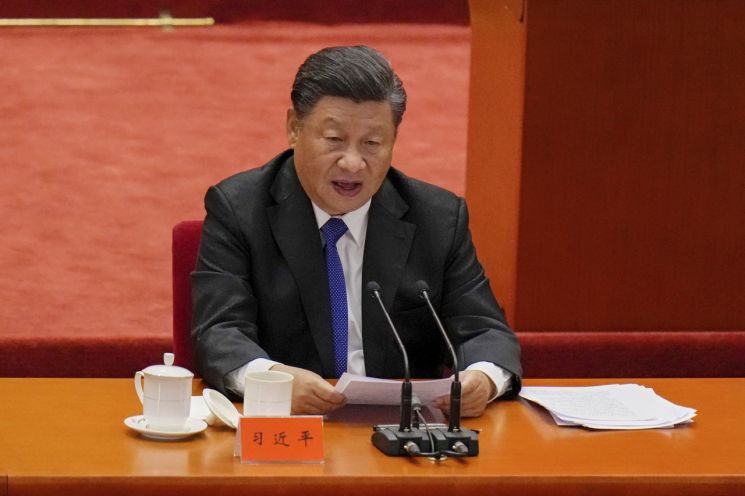

In this situation, measures such as tariff reductions through a US-China agreement and easing of supply chain shocks may be provided. Following the emergency call between the two heads of state last month, contacts in economic, trade, and diplomatic fields have expanded, and a summit meeting is anticipated by the end of the year. Researcher Kim Kyunghwan said, "The downside risk could be the People's Bank of China's conservative monetary policy operation in the fourth quarter of this year. Attention should be paid to the response to the 1.1 trillion yuan reverse repos and MLF maturing in the third week of this month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)