Space Innovation Including Food Hall Renewal... Shinsegae Sales Expected to Reach 1.4369 Trillion KRW

Operating Profit of Lotte and Hyundai with New Stores Increases by Over 30%

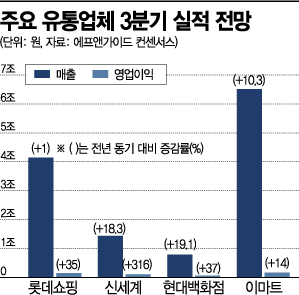

Despite the adverse conditions of the fourth wave of COVID-19, the major three department stores are expected to maintain double-digit growth in their third-quarter performance. Although this is partly due to the low base effect from last year's weak third-quarter results, analysis shows that both sales and operating profits increased thanks to the effects of new store openings and a surge in revenge consumption centered on luxury goods.

Shinsegae Department Store Operating Profit Up 316%

According to the distribution industry and financial information firm FnGuide on the 8th, Shinsegae is expected to achieve third-quarter sales of 1.4369 trillion KRW this year, an 18.3% increase from 1.2144 trillion KRW in the third quarter of last year. Operating profit is projected to rise 316% to 104.9 billion KRW from 25.2 billion KRW in the third quarter of last year, which was hit hard by COVID-19.

Shinsegae Department Store has been innovating its spaces, including a major renewal of the Gyeonggi branch's food hall in July and the opening of a mezzanine space concept on multiple floors at the Gangnam branch, the top domestic sales location, in August. The newly opened 'Daejeon Art & Science,' the first new store in five years, is also attracting local customers and enjoying a strong opening effect.

Emart is also expected to see third-quarter sales increase by 10.3% year-on-year to 6.5179 trillion KRW, with operating profit rising 14.0% to 172.3 billion KRW. This is attributed to the success of its large mart renewal strategy focused on strengthening fresh food, as well as the rapid growth of its warehouse-style store, Traders. Traders recorded sales of 303.2 billion KRW in August alone, a 14.5% increase compared to the same period last year.

Lotte and Hyundai Benefit from New Store Openings

Lotte Shopping's third-quarter sales are expected to be around 4.1452 trillion KRW, similar to 4.1059 trillion KRW in the third quarter of last year. However, operating profit is projected to increase by 34.5% to 149.3 billion KRW.

Lotte Shopping anticipates sales growth thanks to the openings of Lotte Department Store's 'Dongtan Branch' and the premium outlet 'Time Villas' in August and September, respectively. The restructuring of underperforming stores, which was focused on Lotte Mart and Lotte Super last year, has been temporarily halted. Instead, the company plans to expand its warehouse-style marts, Big Market, from the current two stores to 20 stores by 2023, resuming store expansion.

Hyundai Department Store is expected to post sales of 788.9 billion KRW, a 19.1% increase year-on-year, and operating profit of 61.3 billion KRW, up 37.1%. Although operations were suspended for a week due to a cluster infection at the Trade Center branch in July, steady consumer sentiment and strong sales centered on luxury goods have driven performance.

Stable sales growth is also being pursued through 'The Hyundai Seoul,' which opened in February this year, and the premium outlet 'Space One,' which opened in November last year. The duty-free business is also expected to improve in both sales and profits in the third quarter compared to the second quarter, benefiting from the peak season ahead of China's National Day holidays in August and September.

Retail Industry Preparing for 'With Corona'

The retail industry expects that with the completion of COVID-19 vaccinations, the 'With Corona' atmosphere will spread in earnest from late this month, leading to a significant recovery in consumer sentiment and an increase in offline store visitors.

A department store official said, "Although the economic outlook for the retail and department store sectors in the fourth quarter is not entirely optimistic due to uncertainties about the end of COVID-19, preparations are underway on the ground for a phased return to normal life. If consumer sentiment revives through large-scale discount events in the second half, such as the Korea Sale Festa, and demand for outings increases, sales of luxury goods will be followed by significant growth in cosmetics, fashion, and accessories."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.