Shipping Rates Triple in One Year

North America and Europe Routes Face Loading Delays

Home Appliance Industry Struggles with Semiconductor and Other Parts Shortages

"Shipping on the desired date has become a thing of the past. We used to coordinate shipping dates with forwarders, but recently they are pleading to have the goods arrive by mid-November. Even so, we cannot confirm the shipping date. Being told we have to wait a month for product shipment is just frustrating."

Since the COVID-19 pandemic, global port congestion has worsened, causing growing concerns among domestic exporters ahead of the year-end shopping seasons such as Black Friday and Christmas. Over the past year, ocean freight rates have surged more than threefold, increasing logistics costs, and there are not even vessels available to transport products to North America or Europe. While shipping schedules used to require about a week of waiting, they now take over a month, raising fears that exporters will miss out on the year-end shopping boom.

Ocean Freight Rates Triple in One Year... On-Time Sailing Rate Drops Below 10%

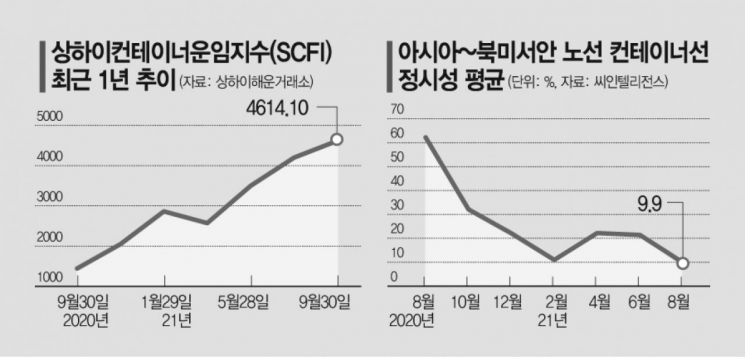

According to the shipping industry on the 5th, the Shanghai Containerized Freight Index (SCFI), which aggregates freight rates for 15 container shipping routes, soared from 1443.54 on September 30 last year to 4614.10 as of September 30 this year, a 3.12-fold increase. During the same period, freight rates for 1 FEU (12-meter container) on the Asia to North America West Coast route, a major export route for Korea, rose from the high $3,000s to over $6,000.

This is due to the sharp increase in global cargo volumes after the COVID-19 outbreak, which intensified the phenomenon of vessels waiting near ports, known as vessel congestion. According to Danish shipping analytics firm Sea-Intelligence, as of August, the on-time performance of container ships on the Asia to North America West Coast route was 9.9%, a 52.3 percentage point drop from 62.2% in the same period last year. On-time performance indicates how well shipping companies adhere to scheduled vessel timings; while last year 6 out of 10 container ships met their schedules, this year not even one ship is able to maintain the schedule properly.

The worsening port congestion is directly impacting exporters. As it becomes difficult to meet departure schedules on time, additional costs such as storing goods near ports are increasing. Even so, the container storage yards near Busan New Port were already full earlier this year, forcing storage in places like Yangsan, which is farther from the port. A representative from a domestic export company lamented, "The average time from departure at Busan New Port to unloading at the North America West Coast port of Los Angeles used to be 10 days, but recently it takes 3 weeks to over a month, making it impossible to endure any longer."

Peak Shopping Season... Headaches for the Home Appliance Industry

The industry most affected by the logistics difficulties is the home appliance sector, which faces the year-end shopping peak. The fourth quarter is typically the peak season due to events like Black Friday and Christmas holidays, which drive high home appliance consumption. However, ongoing logistics issues have caused shipping costs to rise sharply, reducing profitability and making it difficult to deliver key products like TVs on time.

Samsung Electronics and LG Electronics are increasing production at overseas factories in the U.S. and Mexico. Since sales mainly increase in North America during the fourth quarter, they are seeking to strengthen localization to meet the increased local demand. Whirlpool, considering rising transportation costs, is reportedly focusing its limited production capacity on premium, high-margin products rather than mid- to low-priced items for production and sales.

The home appliance industry is also facing component shortages such as semiconductor supply issues, in addition to logistics problems. With raw material prices like steel rising sharply, production costs are increasing, and the semiconductor shortage is expected to continue into next year.

A market insider said, "Up to the third quarter, sales expanded due to the effects of COVID-19, so record-breaking performance is expected, but there are ongoing concerns about future conditions due to global logistics difficulties, power shortages in China, and component shortages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.