Improved Marketability and Increased Subsidies Lead to Successive Launches of Compact Electric Vehicles

Joining the Mainstream Market Focused on Practicality Intensifies Price Competition

[Asia Economy Reporter Ki-min Lee] As demand for compact electric vehicles increases and new models continue to be launched, it is expected that price competition focused on practicality will intensify in the electric vehicle sector.

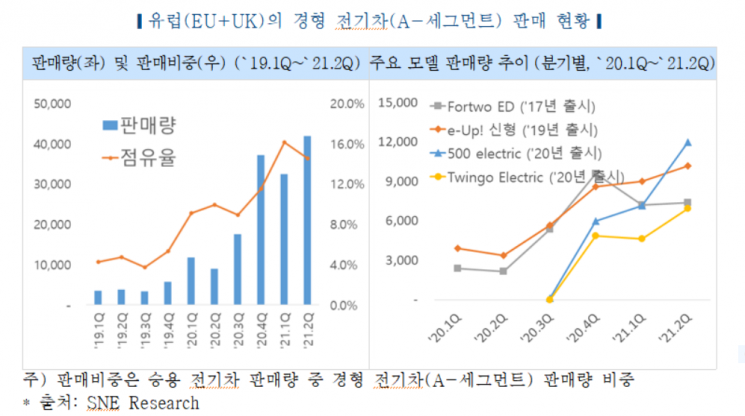

According to the industrial trend report from the Korea Automotive Technology Institute on the 5th, sales of compact electric vehicles released by European automakers such as Volkswagen, Stellantis, Daimler, and Renault are rapidly increasing, expanding their share of total electric vehicle sales.

Volkswagen's 'e-up!', which held a 36.7% market share in the electric vehicle market in the second quarter of this year, sold 3,000 units in the first quarter of last year but sold more than 9,000 units in the second quarter of this year. Following that, Stellantis (market share 28.8%)'s 'Fiat 500 Electric' has steadily increased sales since its launch in the third quarter of last year, selling 12,000 units in the second quarter, and Renault (market share 16.7%)'s 'Twingo Electric' also sold over 6,000 units during the same period.

By country, Germany, Italy, and France account for about 80% of the compact electric vehicle market, with domestic brand products leading the market in each country while competing with foreign brands.

The Korea Automotive Technology Institute cited improvements in the vehicles' own product quality and government support policies as the reasons behind the strong sales of compact electric vehicles. Firstly, the recently released models are not the size of the old ultra-compact models but are the size of internal combustion engine compact cars, and with longer driving ranges, their utility has increased, attracting more customers.

Moreover, the government's electric vehicle purchase support policies, such as a regressive subsidy structure that provides higher subsidies for lower sales prices and increased subsidies after COVID-19, have had a positive effect. The institute gave the example of Volkswagen's German electric vehicle market, explaining that Volkswagen's e-up! has price competitiveness comparable to internal combustion engine cars when subsidies are included, selling more than Tesla's Model 3 and others.

The Korea Automotive Technology Institute forecasted that, like the European compact electric vehicle case, although it is difficult to find innovation beyond electrification based on internal combustion engine cars, price competition will intensify as these vehicles join the mainstream market riding the wave of practical consumer demand.

In particular, considering each country's plans to reduce subsidies, achieving sufficient price reductions is necessary to overcome the demand decline and stagnation existing between the initial market and the mainstream market.

A representative from the Korea Automotive Technology Institute said, "With major automakers planning to launch affordable electric vehicles centered on compact and small cars such as Hyundai's Casper, Tesla's Model 2, and Renault 5, price reduction competition to capture the mainstream market will intensify."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.