Retail Business Sentiment Index (RBSI) 103 (2Q) → 106 (3Q) → 99 (4Q)... Falls Below Benchmark (100) After Two Quarters

[Asia Economy Reporter Kim Hyewon] Expectations for the recovery of the retail distribution industry have declined after two quarters.

The Korea Chamber of Commerce and Industry announced on the 5th that the '2021 4th Quarter Retail Business Survey Index (RBSI)' based on a survey of 1,000 retail distribution companies was recorded at 99. The index showed an upward trend in the 2nd quarter (103) and 3rd quarter (106), but the recovery trend could not continue due to strengthened social distancing measures following an increase in COVID-19 cases. An RBSI above 100 means that more companies view the retail business outlook for the next quarter positively compared to the previous quarter, while below 100 indicates the opposite.

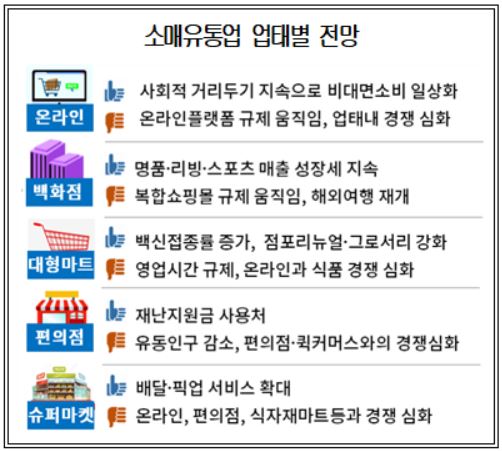

By business type, only online shopping (110) exceeded the baseline. This appears to reflect expectations that online and non-face-to-face consumption patterns will continue. The Korea Chamber of Commerce and Industry analyzed, "With online and non-face-to-face consumption becoming normalized due to COVID-19, even as policies shift to the With-Corona era, consumers who have experienced the convenience of online shopping will continue to use online services."

Department stores (98), large discount stores (85), convenience stores (88), and supermarkets (98) all fell below the baseline. Department stores (107→98) dropped 9 points compared to the previous quarter but recorded a forecast close to the baseline (100), suggesting that the momentum from the 3rd quarter will continue into the next quarter. Although strengthened social distancing and cluster infections in department stores negatively impacted sales, the ban on overseas travel brought a windfall effect and revenge spending, steadily increasing luxury goods sales. Additionally, rising vaccination rates have raised expectations for continued strong performance.

Large discount stores (98→85) fell 13 points from the previous quarter, recording the lowest outlook among business types. The decline was attributed to reduced foot traffic due to strengthened social distancing and intensified competition with online channels for fresh food and daily necessities. Furthermore, regulations such as mandatory twice-monthly closures and restricted operating hours (midnight to 10 a.m.), along with exclusion from disaster relief fund usage except for some leased stores, negatively affected sales growth.

Convenience stores (100→88) also dropped 12 points from the previous quarter, lowering expectations for the next quarter. Although convenience stores were included as disaster relief fund usage locations last year and this year, the 4th quarter is an off-season with decreased foot traffic, which is expected to have a greater impact on sales decline. Increased competition among convenience stores due to store expansion and the spread of quick commerce were also identified as factors limiting sales growth.

Supermarkets (96→98) were the only business type to rise by 2 points, reaching 98. This reflects expectations that more people will choose nearby, small-quantity purchases rather than crowded large discount stores amid the resurgence of COVID-19. However, supermarkets face restrictions such as store opening limits and mandatory closures, fierce competition with online shopping, food material marts, and quick commerce for fresh food, and gradually increasing vaccination rates, so it is expected to take time before entering a stable growth phase.

Regarding countermeasures or preparations for the prolonged COVID-19 situation, cost reduction including labor and operating expenses (38.5%) was the most common response. This was followed by promotions such as price discounts (36.9%) and strengthening online business (31.4%).

As for future key strategies, improving profitability (51.4%), strengthening online business (31.5%), enhancing online-offline linkage (22.9%), and reinforcing logistics and delivery (18.4%) were cited in order, indicating that online competitiveness has become a core competitive advantage for distribution companies amid the prolonged COVID-19 situation.

The biggest management difficulties were cited as weakened consumer sentiment (50%), rising costs including labor, finance, and logistics (16.5%), intensified competition among business types (14.3%), and government regulations (11.6%).

Seo Deokho, Director of the Korea Chamber of Commerce and Industry Distribution and Logistics Promotion Institute, stated, "As vaccination rates increase, discussions on transitioning to the With-Corona phase focusing on gradual daily life recovery at the end of the year are expected to intensify," adding, "Businesses must not neglect efforts to innovate in order to satisfy consumer demands in the With-Corona era."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.