Prospects for Bipartisan Agreement in 18 Days... Possible Rebound as Uncertainty Eases

Focus on This Week's Employment Data Release... Could Increase Market Pressure

U.S. Treasury Secretary Janet Yellen appeared before the Senate Finance Committee hearing on the 28th of last month (local time) and responded to lawmakers' questions regarding the debt ceiling adjustment.

U.S. Treasury Secretary Janet Yellen appeared before the Senate Finance Committee hearing on the 28th of last month (local time) and responded to lawmakers' questions regarding the debt ceiling adjustment. [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] The U.S. federal government's debt ceiling adjustment continues to face difficulties. However, since this is ultimately a solvable issue, it is expected that the worst outcome of a government default can be avoided. Instead, attention should be focused on the upcoming September U.S. employment data and the resulting inflation outlook and exchange rate impact.

The U.S. Federal Government Debt Ceiling as a Factor Awaiting Resolution of Negative News

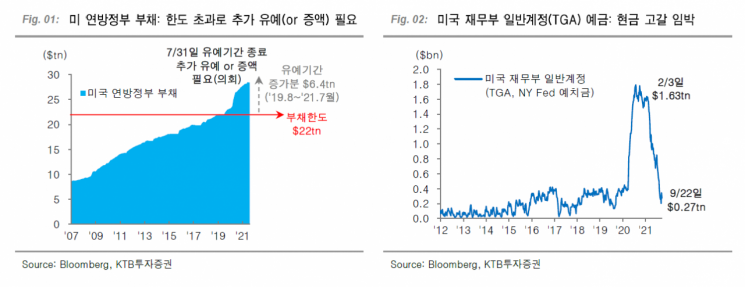

On the 4th, KTB Investment & Securities provided this analysis. Currently, the U.S. Congress remains deadlocked over either an additional extension or an increase of the federal debt ceiling. Previously, a two-year extension decided in August 2019 allowed the U.S. federal government to borrow without limit, but this extension expired at the end of July. As a result, additional borrowing became impossible, and the government has been covering necessary expenditures using the Treasury General Account (TGA) balance. As this balance rapidly depleted, the prospect of a U.S. government default became visible. Treasury Secretary Janet Yellen has projected this point to be around the 18th of this month.

Therefore, an additional extension or increase of the U.S. debt ceiling must be passed by Congress before the 18th. Failure to do so could cause significant shocks to the financial markets. Although similar issues have arisen and been resolved in the past, the market remains highly sensitive due to the severe shock experienced in 2011. On August 2 of that year, despite Congress agreeing to raise the debt ceiling, Standard & Poor's (S&P) downgraded the U.S. credit rating citing extreme uncertainty during the process. This caused market volatility to surge, and the KOSPI fell approximately 21% over the following month.

However, KTB Investment & Securities predicts that the worst-case scenario of a U.S. government default will not materialize. The failure to pass debt ceiling adjustments in the past was essentially a political "tug-of-war." Park Seokhyun, head of the macro team at KTB Investment & Securities, stated, "If the Democratic Party abandons its plan to package the debt ceiling with other bills (the 2022 fiscal year budget and infrastructure/social welfare bills) and proceeds with separate handling, the Republican Party will find it difficult to oppose solely for political positioning due to the responsibility burden. Therefore, bipartisan agreement is likely to be reached in time." He added, "Thus, the U.S. federal government debt ceiling issue should be viewed as a factor awaiting the resolution of negative news and could serve as a potential catalyst for a stock price rebound once uncertainty is resolved."

Focus on Employment, Inflation, and Exchange Rates

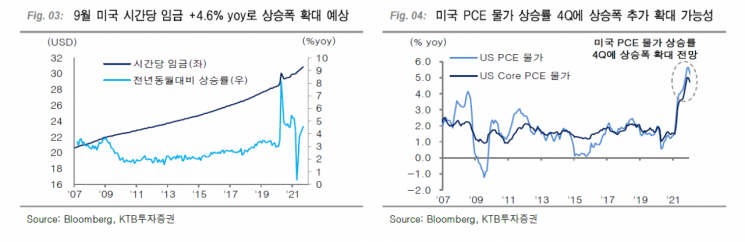

He emphasized that the key points are employment data, inflation outlook, and exchange rate trends. The U.S. ADP employment report and the September private employment data will be released on the 6th and 8th local time, respectively. Park said, "A slight improvement in the nonfarm payroll change is expected, which could ease pressure on the Federal Reserve's monetary policy stance alongside an improved economic outlook." However, he noted, "The expected sharp rise in hourly wage growth could increase inflationary pressure and influence a stronger dollar and a weaker Korean won." Consequently, this may impose more burden on emerging market stock markets than on developed markets, making it difficult to resolve uncertainty in the KOSPI market.

In fact, the U.S. nonfarm payrolls for September are forecasted to increase by 500,000 compared to the previous month. Escaping last month's employment shock would alleviate concerns about a weak employment environment and correspond to a level that does not further pressure the Fed's monetary policy stance. However, the year-over-year increase in hourly wages for September is expected to rise to 4.6%. Due to labor market supply-demand imbalances, wage growth is likely to continue rising for the time being, adding pressure to inflation. The U.S. personal consumption expenditure (PCE) inflation rate, which may temporarily slow in the third quarter, is expected to accelerate further in the fourth quarter. This remains a source of market anxiety.

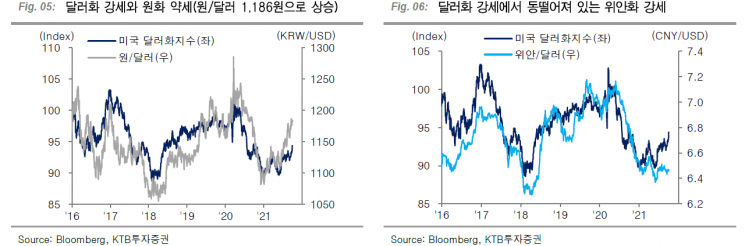

From the foreign exchange market perspective, the dollar index, which has surpassed 94, is expected to rise further. This affects both the won-dollar exchange rate, which has risen to 1,184 won, and the yuan-dollar exchange rate, which is moving independently from the dollar. Park explained, "Exchange rate instability will likely delay the timing for bottom-fishing in large-cap stocks and could increase interest in sectors perceived as beneficiaries of exchange rate movements, such as chemicals, energy, and automobiles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)