Policy Response Must Be Considered... Attention Needed on Consumer, Entertainment, and Eco-Friendly Stocks

On the 30th of last month, a man stood on the road in front of the Guangdong Shenzhen headquarters of Evergrande Group, a major private real estate developer in China. [Image source=Yonhap News]

On the 30th of last month, a man stood on the road in front of the Guangdong Shenzhen headquarters of Evergrande Group, a major private real estate developer in China. [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] Concerns about economic slowdown are emerging due to uncertainties such as the bankruptcy fears of Chinese real estate company Evergrande Group, power shortages, and COVID-19. Analysts suggest that appropriate responses to each issue are necessary.

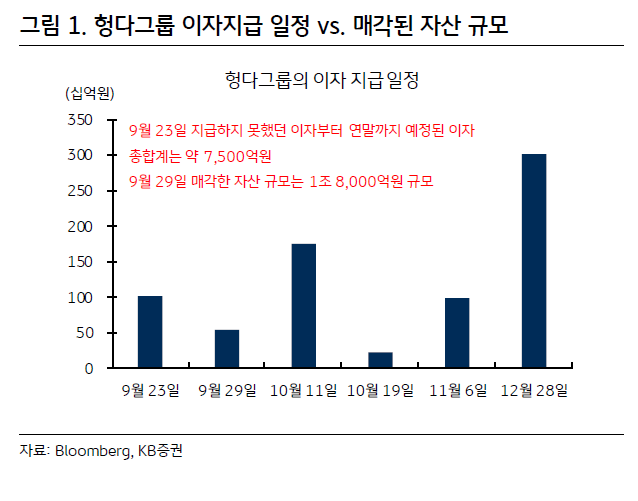

On the 3rd, KB Securities diagnosed the situation and explored countermeasures for each issue. First, they analyzed concerns about economic slowdown stemming from China. Last month, as fears grew due to the possibility of Evergrande Group's bankruptcy and power shortages, the Chinese Economic Sentiment Index (ESI) also declined. Although an asset sale contract worth about 10 billion yuan (approximately 1.844 trillion KRW) was signed on the 9th, debt maturities amounting to tens of trillions of won are still due from next year through the year after next. While the company is holding on through asset sales, considering the scale of its debt, it is expected to be difficult to prevent bankruptcy on its own.

Power shortages are also a problem. This issue could expose the blind spots of eco-friendly policies and thus deserves attention. Additionally, it could lead to production disruptions for South Korean companies with manufacturing plants in China. KB Securities analyzed that while the bankruptcy possibility of Evergrande Group and power shortages are the apparent problems, the expanding concerns about overall economic slowdown inevitably place a burden on the Chinese leadership.

Expectations for Large-Scale Economic Stimulus in China... Increased Optimism for Consumer Stocks

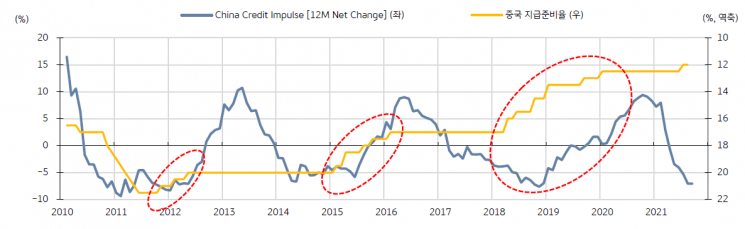

They predicted the Chinese government's response through the 'China Credit Impulse' index, which shows changes in credit growth relative to GDP, indicating turning points in economic activity. Historically, whenever the credit impulse index has fallen to the current level, the Chinese government has invariably implemented economic stimulus measures. KB Securities researcher Hainhwan said, "Although the form of stimulus measures has varied somewhat over time, common elements include reserve requirement ratio cuts and expanded issuance of local government bonds," adding, "There is no doubt that stimulus measures will be introduced soon, but the question is the timing." With the 6th Plenary Session of the 19th Central Committee of the Chinese Communist Party scheduled for early next month and the December economic work conference upcoming, expectations for stimulus measures could rise as early as the end of this month.

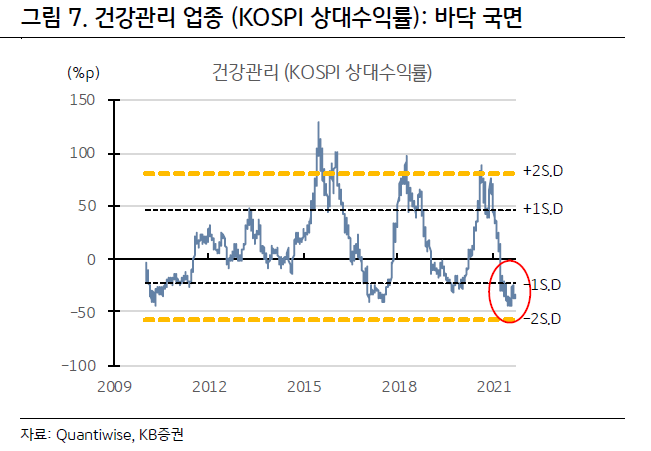

If China enters a stimulus phase, consumer-related stocks are expected to benefit most clearly. Representative sectors include food and beverages, cosmetics, duty-free, and pharmaceutical products (healthcare). However, due to the nature of COVID-19, the recovery of the cosmetics sector may be somewhat delayed. Researcher Ha advised, "Since China's stimulus measures mainly take the form of 'consumption promotion,' it is necessary to increase interest in 'consumer-related stocks' from a mid-term perspective."

Whether the With-COVID Era Begins Also Important... Focus on Contract Manufacturing Stocks

The question of entering the 'with COVID-19' phase could also be a hot topic this month. This issue is being discussed not only domestically but also internationally. KB Securities emphasized the need to pay attention to contract manufacturing-related stocks if the with-COVID phase begins. Once the with-COVID era starts, those who had hesitated due to concerns about side effects are likely to accelerate vaccination. The South Korean government has also expressed its willingness to support vaccine contract manufacturing. Early August's 'K-Global Vaccine Hub Strategy' and President Moon Jae-in's speech at the UN General Assembly last month are in this context. Researcher Ha explained, "If oral therapeutics are developed in the future, the scope could expand to contract manufacturing of therapeutics. Also, attention should be paid to the entertainment sector, where offline performances are resuming, as well as travel."

Acceleration of Eco-Friendly Policies Amid Power Shortages

Attention should also be paid to China's power shortage issue. The fourth quarter is seen as a turning point when domestic and international policies on eco-friendly sectors will be fully implemented. The COP26 (UN Climate Change Conference of the Parties) is scheduled to take place in the UK at the end of this month. In South Korea, the '2050 Carbon Neutrality Scenario' and the '2030 National Greenhouse Gas Reduction Target (NDC)' will be announced at the end of this month. Additionally, many carbon neutrality-related policies are expected to be announced throughout the quarter. Researcher Ha predicted, "The Social Democratic Party's victory in Germany's general election and the passage of the US economic stimulus package could raise expectations that investments in eco-friendly sectors will accelerate starting in the fourth quarter."

Furthermore, China's power shortage issue is expected to accelerate policy support for eco-friendly sectors. Researcher Ha summarized the cause of China's power shortage as "a realistic problem arising during the transition to a carbon-neutral society." Since the carbon neutrality target years of major countries are mostly between 2050 and 2060, it is a challenging process requiring 30 to 40 years. Therefore, realistic problems like China's power shortage may occur.

To overcome these realistic problems, the Chinese government is expected to introduce policies in two main directions. First, in the short term, practical responses such as nuclear power are likely to gain more support to prevent recurrence of issues like power shortages. At the same time, policy support for eco-friendly sectors is expected to accelerate further.

Researcher Ha said, "Considerations for practical responses may include expanding nuclear power, developing carbon capture technologies, and expanding carbon emissions trading," adding, "Regarding the acceleration of policy support for eco-friendly sectors, international cooperation could emerge at major upcoming events such as the G20 summit and COP26 scheduled for the end of this month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.