Despite Radical Limit and Interest Rate Forecasts

Banking Sector "Concentration Unlikely to Be Severe"

[Asia Economy Reporter Kiho Sung] As the launch of Toss Bank, the third internet-only bank, enters its final countdown, industry attention is focusing on it. The bank is gradually revealing its groundbreaking deposit and loan products, signaling aggressive marketing efforts in its early stages. In particular, amid tightening household loan regulations by financial authorities, the maximum credit loan limit of 270 million KRW is drawing significant attention. However, industry experts point out that due to the nature of internet banks, there will not be a sudden concentration of loans, and rather, the number of users will be more important.

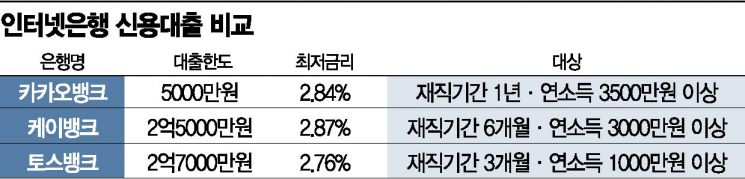

According to the financial sector on the 29th, Toss Bank partially disclosed its loan product lineup on its website on the 26th. There are two types: Saetdol Loan and Credit Loan, with the credit loan limit set at a maximum of 270 million KRW and an interest rate ranging from 2.76% to 15.00% per annum. A Toss Bank official stated, "The limits and interest rates have not been finalized yet, but they are unlikely to change significantly under the current circumstances."

The credit loan conditions of Toss Bank are truly groundbreaking. According to the Bankers Association, last month the average interest rates of the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?ranged from 3.07% to 3.62% per annum. Internet banks Kakao Bank and K Bank had rates of 4.95% and 4.27% per annum, respectively. Especially in an environment where all financial institutions are drastically reducing credit loan balances, a loan limit exceeding 100 million KRW is considered highly attractive. This is why it is expected that borrowers in urgent need of loans will flock to Toss Bank. Additionally, since it is the first year of Toss Bank’s launch, it is anticipated that it may avoid the financial authorities’ total household loan volume management.

The key factor is the number of users. A banking industry official explained, "The maximum credit loan limit is 270 million KRW, but not all customers can receive the maximum limit. Ultimately, the limit varies depending on the credit rating." He added, "Due to the nature of internet banks, the performance of deposits and loans depends not only on conditions but also on the growth rate of users, so Toss Bank is expected to follow the same path."

A representative example is K Bank. Even now, K Bank offers credit loans up to 250 million KRW for salaried workers. The interest rate is as low as 2.89% per annum, and salaried employees who have been employed at the same company for more than six months and have an annualized income of over 30 million KRW can receive loans depending on their personal credit status. In addition, K Bank operates a salaried worker overdraft loan product with a maximum limit of 150 million KRW. The interest rate is also at a low level, at 3.39% per annum.

K Bank attracted the highest number of users in April this year, with cumulative users reaching 5.37 million, up from 3.91 million the previous month. Accordingly, deposits and loans increased by 3.42 trillion KRW and 850 billion KRW, respectively. On the other hand, in August, when the user increase was lower than in April?from 6.28 million (July) to 6.45 million?the deposits increased by 830 billion KRW and loans by 210 billion KRW. At that time, due to financial authorities’ loan regulations, a balloon effect was expected toward K Bank with its high loan limits, but ultimately, the increase in deposits and loans followed the growth in the number of users.

Another banking industry official said, "Since Toss Bank announced it would maintain a 34.9% share of mid-interest loans by the end of this year, it cannot increase credit loans indefinitely," adding, "Rather, the launch of Toss Bank will disperse loan demand, which could be beneficial for other banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.