Personal Loans, 14.9% Mid-Credit Borrowers at 7 Major Banks vs. 8.5% at KakaoBank

[Asia Economy Reporter Park Sun-mi] This year’s first half data shows that the proportion of loans to mid-credit borrowers by internet-only bank KakaoBank is either similar to or lower than that of commercial banks. Although KakaoBank announced at the beginning of this year that it would significantly increase mid-credit loans, there are criticisms that it still does not meet the original purpose of establishing an internet-only bank.

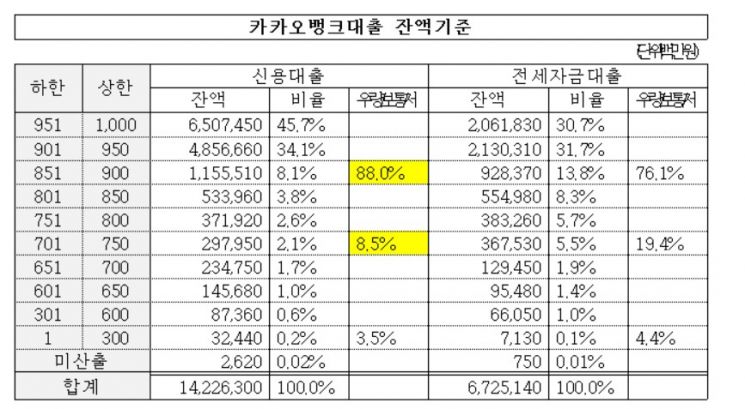

On the 29th, Bae Jin-kyo, a member of the National Assembly’s Political Affairs Committee from the Justice Party, analyzed data on bank credit loans and jeonse deposit loans from the Financial Supervisory Service. According to the analysis, among seven commercial banks?KB Kookmin, Shinhan, Hana, Woori, SC First, Citi, and Industrial Bank of Korea?the proportion of mid-credit borrowers (credit score 701?850) in credit loans (outstanding balance) as of the end of June was 14.9%. KakaoBank’s proportion of mid-credit borrowers was lower at 8.5%. On the other hand, KakaoBank’s proportion of high-credit borrowers (credit score 851 and above) in credit loans was 88%, which is 7.8 percentage points higher than the seven commercial banks’ 80.2%.

Based on the number of accounts, the proportion of high-credit borrowers’ credit loans in the seven commercial banks was 72.3%, while KakaoBank’s was 85.6%. The proportion of mid-credit borrowers was 19.9% for commercial banks but only 10% for KakaoBank.

At last year’s national audit, KakaoBank faced strong criticism for its low performance in mid-credit loans. The Financial Services Commission also released the ‘Mid-Interest Rate Loan System Improvement Plan’ in April, urging fintech financial institutions to expand mid-interest rate loans. KakaoBank had also announced plans to significantly increase mid-credit loans.

Assemblyman Bae said, “During last year’s national audit, I pointed out through an analysis of the three-year credit loan status unique to internet-only banks that the proportion of mid-interest rate loans to mid-credit borrowers was low. Both the Financial Services Commission and KakaoBank promised to expand mid-interest rate products in the future, but the promise has proven hollow.”

He added, “Like commercial banks, KakaoBank continues a profitability-focused lending practice, and the fact that the proportion of high-credit borrowers is rather high shows that the policy to have internet-only banks handle mid-interest rate loans suitable for mid-credit borrowers has failed. Therefore, additional institutional improvements should be pursued.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)