[Asia Economy Reporter Kwangho Lee] The amount of credit loans exceeding 100 million KRW taken out to purchase houses and subsequently recalled by banks reached 12.9 billion KRW.

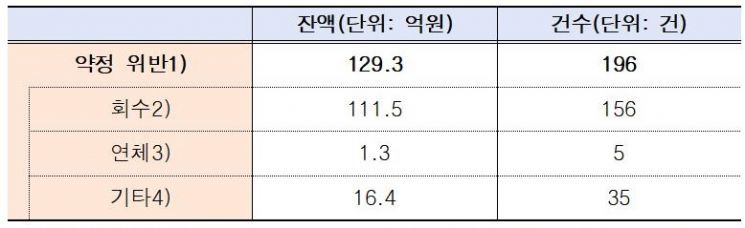

According to the 'Loan Recall Status for Housing Purchases in Regulated Areas by the Five Major Banks including KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup,' submitted by Rep. Kim Sang-hoon of the People Power Party, a member of the National Assembly Land, Infrastructure and Transport Committee, based on data from the Financial Supervisory Service, from the end of November 2020 to the end of July 2021, there were a total of 196 cases where credit loans were recalled, amounting to 12.93 billion KRW over approximately eight months.

In November last year, the government announced regulations on credit loans for housing purchase funds. In particular, if a credit loan exceeding 100 million KRW was taken and a house was purchased within one year in a regulated area (speculative area, speculative overheating district, or adjusted target area), full repayment was required immediately.

As a result, 196 cases amounting to approximately 12.93 billion KRW were notified for breach of contract, of which 156 cases totaling 11.15 billion KRW were actually repaid. Among the remaining amount, 1.64 billion KRW was deferred due to borrower objections, and 5 cases (130 million KRW) have not yet been recovered and are overdue beyond the due date.

Rep. Kim stated, "It is questionable whether it is reasonable to seize loans just because the borrower bought a house, regardless of their repayment ability and financial situation," and pointed out, "This effectively reduces the opportunity for genuine buyers who inevitably purchased homes through 'Yeongkkeul' to own their own homes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.