Highest in 3 Years... WTI Also

Oil Demand Recovers to Previous Levels

Domestic Gasoline Prices on the Rise

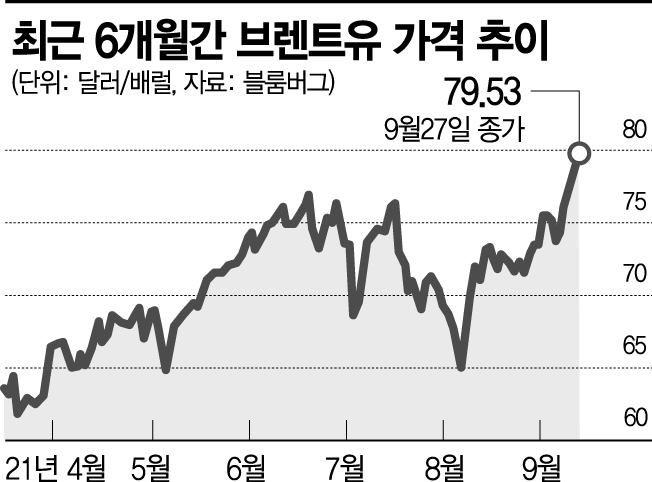

[Asia Economy Reporters Choi Dae-yeol and Cho Hyun-ui] North Sea Brent crude oil surpassed $80 per barrel on the 28th. It surged with six consecutive days of increases amid concerns over supply shortages. Some forecasts even suggest it could exceed $90 within the year.

According to Bloomberg News, Brent crude was priced at $80.19 per barrel as of 1:10 PM that day, marking a 0.8% increase. This is the highest level since October 2018.

West Texas Intermediate (WTI) crude oil for November delivery was trading at $76.27 per barrel as of 1:55 PM, up 0.8% from the previous trading day. WTI, which has also risen for six consecutive trading days, is at its highest level since October 2018.

Investment bank Goldman Sachs projected that Brent crude prices will surpass $90 by the end of this year. Considering the impact of Hurricane Ida, they revised their previous forecast from $80 to $90. The WTI price forecast was also raised from $77 to $87.

Goldman Sachs stated, "Ida has impacted U.S. crude oil supply to an extent that more than offsets the production increase by OPEC+ (the Organization of the Petroleum Exporting Countries (OPEC) member countries and non-OPEC allies)." They added, "Additionally, as the impact of the Delta variant virus diminishes, oil demand in the Asia region is recovering to pre-pandemic levels. Although oil-producing countries will negotiate production volumes next week, it is unlikely to deviate from our forecast."

International oil prices are expected to remain higher than pre-COVID-19 levels. The Bank of Korea, in its report titled 'Assessment of Recent International Oil Price Trends and Future Outlook' released the previous day, predicted that international oil prices will maintain around $70 per barrel in the second half of this year. Although prices are expected to decline gradually after next year, due to ongoing supply-demand imbalances, they will remain higher than pre-pandemic levels.

On the 28th, as domestic gasoline prices steadily rose, maintaining the highest level in three years at the 1,600 won range, fuel price information was displayed at a gas station in Seoul. Photo by Jinhyung Kang aymsdream@

On the 28th, as domestic gasoline prices steadily rose, maintaining the highest level in three years at the 1,600 won range, fuel price information was displayed at a gas station in Seoul. Photo by Jinhyung Kang aymsdream@

Domestic gasoline prices at gas stations have also turned to a slight upward trend since last weekend. According to the Korea National Oil Corporation, the gasoline retail price in Seoul was 1,729.1 KRW per liter, up 1 KRW from the previous day. The nationwide gasoline retail price also rose by 0.14 KRW to 1,644.07 KRW per liter.

Domestic gasoline prices had sharply increased for 15 consecutive weeks since early May but paused their rise in mid-last month. After five consecutive weeks of slight declines, prices have shown a modest rebound since last week. Considering the lagging nature of domestic gasoline prices following international oil prices, domestic gasoline prices are expected to rise further.

Natural gas, which has been soaring alongside crude oil, continues to exert pressure on inflation. October natural gas prices closed at $5.706 per million Btu, up 11.01% from the previous day. This is the highest price since February 2014.

Warnings have been issued that the situation in Europe will become particularly severe as the winter heating demand season approaches. Europe depends on Russian natural gas for about 40% of its consumption, but Russia recently announced it would reduce exports to Europe to increase exports to the Asia region. Bloomberg News expressed concern, stating, "The natural gas crisis originating in Europe will spread to other regions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.