Only 140,000 Sign-ups Since July Launch

Existing Real Loss Conditions Favor Retention Over Switching

[Asia Economy Reporter Oh Hyung-gil] The '4th generation' indemnity medical insurance, created under the leadership of financial authorities, is turning into a burden. Since its launch in July, only 140,000 people have newly subscribed or switched to it. This accounts for just 0.004% of the 35 million existing indemnity insurance policyholders.

The 4th generation indemnity insurance, designed to resolve the structural problem of losses incurred the more it is sold, is ironically being ignored by the public. Experts point out that non-reimbursable services at medical institutions, which induce excessive treatment, need to be managed.

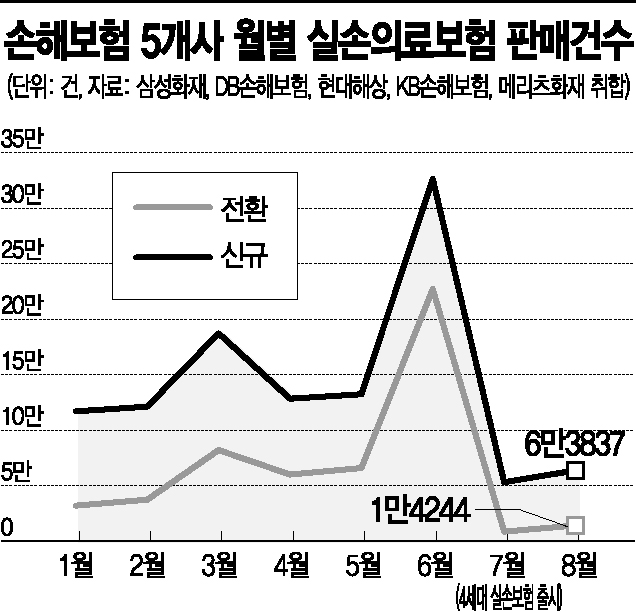

According to the insurance industry on the 28th, the number of 4th generation indemnity insurance subscriptions among five major non-life insurers?Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, and Meritz Fire & Marine Insurance?has been only 141,791 since its launch in July.

The number of indemnity insurance subscriptions recorded 150,000 in January and February, increased to 270,000 in March ahead of product revisions, and then recorded 180,000 and 190,000 in April and May respectively. In June, just before the July revision, 550,000 policies were sold. However, after the 4th generation product was launched in July, subscriptions sharply dropped to 63,710, and August also saw only 78,081 subscriptions.

This is interpreted as many people switching to the 3rd generation indemnity insurance before the 4th generation was launched. The industry believes that consumers, anticipating premium hikes, switched before the 4th generation launch. For those in their 50s and 60s who had existing indemnity insurance, premiums mostly doubled, and the majority chose the 3rd generation instead of the 4th.

The 4th generation indemnity insurance differs from the 3rd generation, which integrated reimbursable and non-reimbursable coverage, by separating reimbursable and non-reimbursable treatments into the main contract and special contracts. This structure aims to prevent loss ratios from rising due to increased non-reimbursable treatments. Also, the self-pay ratio for reimbursable items increased from 20% in the 3rd generation to 30% in the 4th generation. In return, premiums are cheaper.

Premiums are discounted or surcharged based on non-reimbursable usage. If no claims for non-reimbursable items were made in the previous year, premiums are discounted; however, premiums are adjusted differentially as follows: 100% increase for 1 million to 1.5 million KRW, 200% increase for 1.5 million to 3 million KRW, and 300% increase for over 3 million KRW.

This is why the insurance industry expects the conversion rate to the 4th generation indemnity insurance to remain low. A non-life insurer official explained, "From the consumer's perspective, the existing indemnity insurance offers better conditions, so sales did not increase sharply."

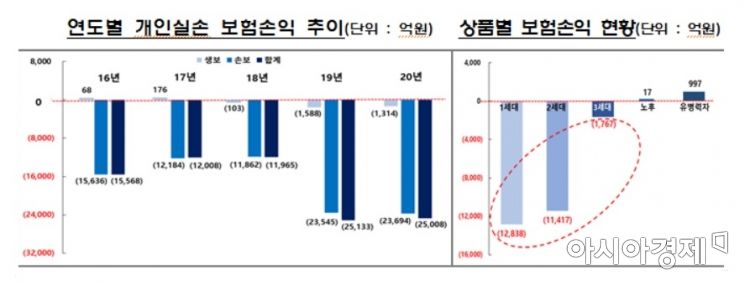

Accordingly, concerns are widespread that the chronic deficit problem of indemnity insurance will continue until existing policyholders switch to the 4th generation product. In the first half of this year alone, non-life insurers' indemnity insurance losses reached 1.4128 trillion KRW, a 17.9% increase from 1.1981 trillion KRW in the same period last year. As a result, some insurers have stopped selling indemnity insurance, which has led to consumer harm.

Experts point out that, as non-reimbursable medical expenses such as cataract surgery and physical therapy surge, urgent measures to manage non-reimbursable services are needed. According to the Korea Insurance Research Institute, indemnity insurance claims for cataract surgery are estimated to reach 1.1528 trillion KRW this year, a 77.9% increase from 648 billion KRW last year.

Jung Sung-hee, a research fellow at the Korea Insurance Research Institute, said, "Cataract surgery is a typical case showing that non-reimbursable management is not being properly implemented," adding, "We need to enhance the public's right to know through investigation and disclosure of non-reimbursable cost information, and establish guidelines for socially acceptable non-reimbursable prices and usage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)