Cashback on Card Spending Over Limit

Excluding Large Marts and Online Malls

Concerns Raised Over Fairness Among Businesses

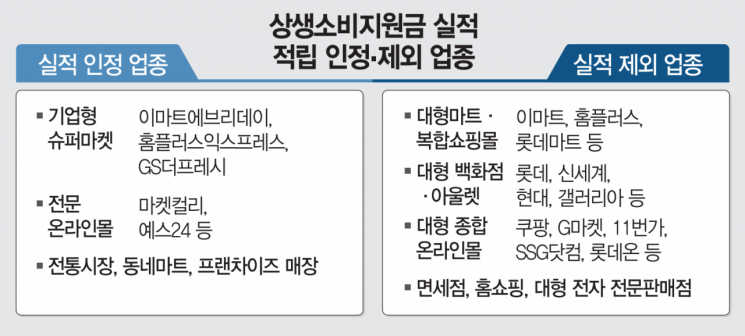

[Asia Economy Reporter Lim Chun-han] The win-lose situation among retail sectors has emerged over the upcoming implementation of the Win-Win Consumption Support Fund (credit card cashback) program starting next month. Department stores, large supermarkets, and major online malls were excluded from the cashback performance accumulation targets, while corporate supermarkets (SSM) and specialized online malls were included. Industry insiders point out that the effect of revitalizing private consumption will be minimal as companies with a high proportion of daily necessities sales are largely excluded.

◆Confusing Card Cashback Criteria = Card cashback is a system that refunds 10% of the excess amount when the monthly card usage exceeds the average monthly usage in the second quarter by more than 3%. According to the card cashback implementation plan announced by the Ministry of Economy and Finance, consumption at department stores, large supermarkets, duty-free shops, large comprehensive online malls, and home shopping is not included in the cashback performance. On the other hand, unlike disaster relief funds, performance is recognized at SSMs such as Emart Everyday, Homeplus Express, and GS The Fresh (supermarkets), specialized online malls related to food and accommodation such as Market Kurly and Yanolja, and franchise stores operated directly like Starbucks and movie theaters.

Large supermarkets and department stores expressed regret over the scope of cashback application. A representative from a large supermarket said, "We are subjected to all kinds of regulations just because we are large corporations, and it is unfortunate that we are excluded again this time. It is somewhat fortunate that SSMs are included, but their overall proportion is not large."

◆Controversy over Fairness Among Companies = The industry criticizes the ambiguous scope of cashback targets. In particular, among offline businesses, large supermarkets are excluded, but SSMs operated by large retailers are included, which is controversial. Regarding this, Han Hoon, Deputy Minister of the Ministry of Economy and Finance, explained, "Retail sales increased by 12% in the first half of this year, but SSM sales decreased by 10%, so they can be considered a damaged industry. Also, nearly 30% of SSM stores are operated by small business owners or self-employed individuals as franchise stores, which was taken into consideration."

Fairness issues are also raised among online companies. Coupang, Gmarket·Auction·G9, 11st, SSG.com, and Lotte On were excluded, while Baedal Minjok and Market Kurly were included. An e-commerce industry official criticized, "Baedal Minjok is a German global company, and Market Kurly is also effectively backed by large capital. We do not understand the criteria. There is a problem with fairness."

◆Exclusion of Online Shopping, Effectiveness = Although non-face-to-face transactions became the trend due to COVID-19, doubts about the consumption stimulation effect are growing as major e-commerce companies are excluded from the targets. According to Statistics Korea, online shopping transaction volume in July was 16.1996 trillion won, a 24.9% increase compared to the same month last year. An industry insider pointed out, "This is a policy to revitalize consumption, but it is incomprehensible that online malls with a high proportion of daily necessities sales are excluded. In the case of open markets, many small business sellers can benefit from increased sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.