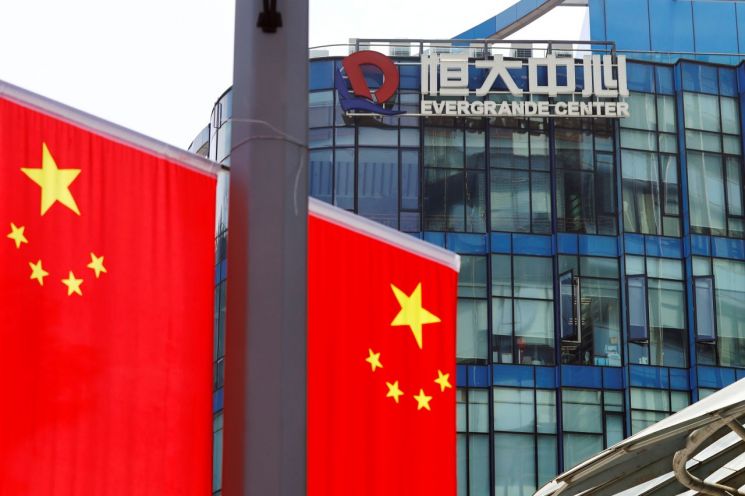

[Asia Economy Reporter Jang Hyowon] As China’s Evergrande Group faces a liquidity crisis, unable to pay interest on its 350 trillion won debt, concerns are growing among domestic secondary battery equipment companies that have supply contracts with its affiliate Evergrande Auto. Evergrande Auto itself is also likely to be unable to receive the remaining payments due to a cutoff in its funding sources.

According to industry sources on the 28th, Evergrande Group announced plans to invest about 120 billion yuan (approximately 22 trillion won) to build three major bases leading advanced scientific technologies such as complete vehicles, batteries, and motors. This is in line with China’s policy to promote the development of the new energy vehicle industry.

Accordingly, Evergrande Group’s electric vehicle company Evergrande Auto has consecutively signed supply contracts with domestic secondary battery equipment companies since 2019.

Wonik P&E signed a supply contract worth 17.4 billion won for secondary battery charge-discharge equipment with Evergrande Auto (Yangzhou Evergrande Neoenergy Technology Development) in January. This amount corresponds to 11.8% of Wonik P&E’s total sales in the previous year. The contract period is until January 5 of next year.

Yuil Enertech signed a supply contract for secondary battery automated assembly equipment with Evergrande Auto at the end of last year. Although the exact amount was not disclosed, considering the order situation of similar companies around the same time, it is estimated to be between 10 billion and 20 billion won. As of the end of last year, Yuil Enertech’s total order backlog was 52.6 billion won.

Mplus signed a supply contract worth 26.4 billion won with Evergrande Auto in February. This amount corresponds to 25.3% of its total sales last year. The contract expiration date was until the 12th of last month but is understood to have been postponed.

The completion of supply contracts for these companies, including Mplus, has become uncertain. This is because Evergrande Group is in a liquidity crisis burdened with debt amounting to 350 trillion won, which has worsened the financial condition of its affiliate Evergrande Auto.

According to major foreign media, Evergrande Auto is reportedly unable to pay some employee salaries and payments to partner companies. The stock price of Evergrande Auto on the Hong Kong stock market has also fallen by more than 90% compared to the beginning of the year.

A financial investment industry official analyzed, “If there is no signal of financial restructuring such as Evergrande Auto being sold to another company, domestic contractors may not receive the remaining payments.”

According to the industry, domestic companies received about 50% of the initial order amount as a down payment from Evergrande Auto and produced the products. However, it is reported that they have not even been able to ship the products because the remaining payments have not been received.

Representatives of these companies said, “We are currently in contact with Evergrande Auto to receive the remaining payments,” and added, “Even in the worst-case scenario, we plan to minimize losses by properly recovering the parts used in the products.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.