Kookmin Bank to Reduce Loan Limits from 29th

Balloon Effect as Nonghyup and Hana Bank Tighten

Shinhan and Woori Banks Have Room but Risk Concentration

[Asia Economy Reporter Kwangho Lee] Following NH Nonghyup and Hana Bank, KB Kookmin Bank is also significantly reducing the household loan limits. The household loan growth rate is approaching the financial authorities' management target of 5-6% for this year, putting loan windows at risk of closing entirely. As the loan cliff becomes a reality in three of the five major banks, there is a strong possibility of a balloon effect toward Shinhan and Woori Banks, which still have some leeway. With the possibility of a domino effect of loan suspensions by banks and tightening of loans extending to the secondary financial sector, the frustration and backlash from real demand borrowers preparing for marriage and moving are expected to intensify.

According to the financial sector on the 27th, Kookmin Bank will significantly reduce the limits on mortgage loans, jeonse deposit loans, and group loans starting from the 29th.

The limit on jeonse deposit loans will be restricted to the range of the increase in the rental deposit (jeonse price). For example, if the jeonse price rises from an initial 400 million KRW to 600 million KRW, an increase of 200 million KRW, tenants without existing jeonse deposit loans could previously borrow up to 80% of the jeonse price (600 million KRW), which is 480 million KRW. However, from the 29th, loans exceeding the increase in the jeonse price of 200 million KRW will not be allowed.

The collateral criteria for move-in balance loans among group loans will change from "KB market price or appraisal value" to "the lowest amount among the sale price, KB market price, and appraisal value." For example, if the sale price of an apartment is 500 million KRW but the current market price has jumped to 1 billion KRW, the loan limit for the balance loan will now be based on the original sale price of 500 million KRW, not the 1 billion KRW market price.

In mortgage loans, subscription to Mortgage Credit Insurance (MCI) and Mortgage Credit Guarantee (MCG) will be restricted. MCI and MCG are insurances subscribed simultaneously with mortgage loans; borrowers with these insurances can borrow up to the Loan-to-Value (LTV) ratio, but without insurance, only the amount excluding small rental deposits can be borrowed.

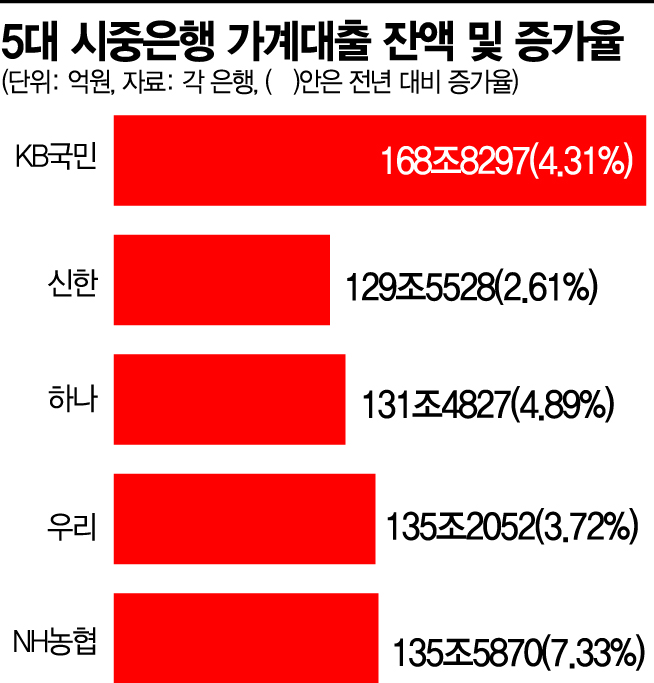

This measure follows NH Nonghyup Bank's loan restrictions last month, which caused a balloon effect toward Kookmin Bank. As of the 23rd, Kookmin Bank's household loan balance was 168.8297 trillion KRW, an increase of 4.31% compared to the end of last year. Although it did not exceed the 5-6% growth target set by financial authorities, the rapid growth rate is problematic. Kookmin Bank's household loan growth rate was only 2.58% at the end of July, then jumped 1 percentage point to 3.62% in one month, and soared to 4.31% as of the 23rd of this month.

As Kookmin Bank, which has the largest household loan volume among domestic banks, tightens loans, other banks are preparing for a balloon effect. Hana Bank, which recorded a household loan balance of 131.4827 trillion KRW as of the 23rd, a 4.89% increase from the end of last year, will temporarily restrict some MCI and MCG loan products starting next month on the 1st.

Shinhan Bank and Woori Bank have household loan balances of 129.5528 trillion KRW and 135.2052 trillion KRW, respectively, with increases of 2.61% and 2.72% compared to the end of last year, indicating some room, but they are closely monitoring the situation due to potential concentration effects.

An official from a bank said, "The financial authorities' strong intention to manage household loans will raise the loan thresholds further," adding, "Loan demand is expected to surge next month, which coincides with the marriage and moving seasons, so we are worried." In fact, October is the month with the highest household loan demand throughout the year. According to the Financial Supervisory Service, the average monthly household loan increase over six years from 2015 to 2020 was highest in October at 1.08 trillion KRW.

Despite the expected loan cliff for real demand borrowers, the financial authorities have no plans to revise the total household loan growth target. A financial authority official emphasized, "There are no plans to adjust the total household loan target," and added, "We will monitor the household loan growth trend and prepare additional measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)