KOSPI Net Sold 1.5454 Trillion KRW This Month

Krafton Bought 251.8 Billion KRW, Ranking 1st

[Asia Economy Reporter Park Jihwan] While pension funds have maintained their selling trend since the beginning of the year, offloading stocks worth 1.5 trillion KRW in the KOSPI this month, they have simultaneously purchased stocks worth several hundred billion KRW in companies such as Krafton and Hyundai Heavy Industries. On the other hand, pension funds have reduced their holdings in companies like Kakao and NAVER amid government industrial regulation concerns.

According to the Korea Exchange on the 27th, pension funds have net sold stocks worth 1.5454 trillion KRW in the KOSPI from the 1st to the 24th of this month. The net selling volume of pension funds in the KOSPI since the beginning of this year has reached 22.5084 trillion KRW, which is eight times the 2.8135 trillion KRW net selling amount recorded last year. The pension funds' net selling streak in the KOSPI is interpreted as an adjustment of the National Pension Service's domestic stock target ratio. The National Pension Service's domestic stock portfolio target ratio by the end of this year is 16.8%, but as of the end of June, the domestic stock ratio stands at 20.3%, exceeding the target.

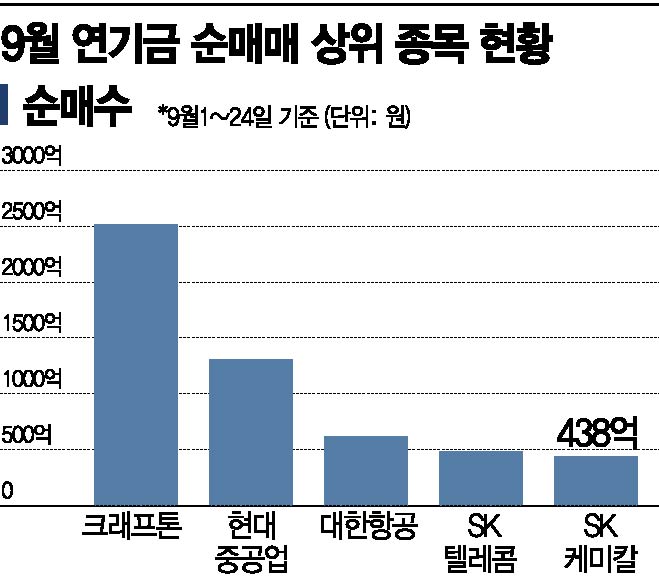

The stock that pension funds have purchased the most in the KOSPI this month is Krafton, with a net purchase of 251.8 billion KRW. The high expectations for earnings driven by the global success of the upcoming release of ‘Battlegrounds: New State,’ which has surpassed 40 million pre-registrations, are cited as the reason for this choice. The early inclusion in the KOSPI 200 index also appears to have attracted passive funds from large-cap funds tracking the index.

Hyundai Heavy Industries, ranked second in pension fund net purchases with 130.7 billion KRW, has seen rising expectations for order improvements and ship price increases as the recent surge in container ship freight rates spreads to ship orders. Choi Jin-myung, a researcher at NH Investment & Securities, forecasted, "As the global industry leader with an overwhelming market share in high value-added ships including LNG carriers, Hyundai Heavy Industries is expected to show a favorable profit growth trend from the second half of the year due to the strong dollar, rising ship prices, and pre-setting of provisions for increased material costs."

Additionally, pension funds have concentrated purchases in Korean Air (61.9 billion KRW), SK Telecom (48.4 billion KRW), and SK Chemicals (43.8 billion KRW). These stocks share the commonality of being the most competitive in their sectors amid industry booms. Notably, pension funds also made significant net purchases of Asiana Airlines (37.7 billion KRW), signaling expectations for normalization in the travel industry despite the ongoing spread of COVID-19. Shin Seung-jin, a researcher at Samsung Securities, said, "Korean Air is expected to benefit from strong air cargo demand due to prolonged shipping and logistics congestion, and with the easing of the COVID-19 situation, improvements in the profitability of the passenger segment are also anticipated."

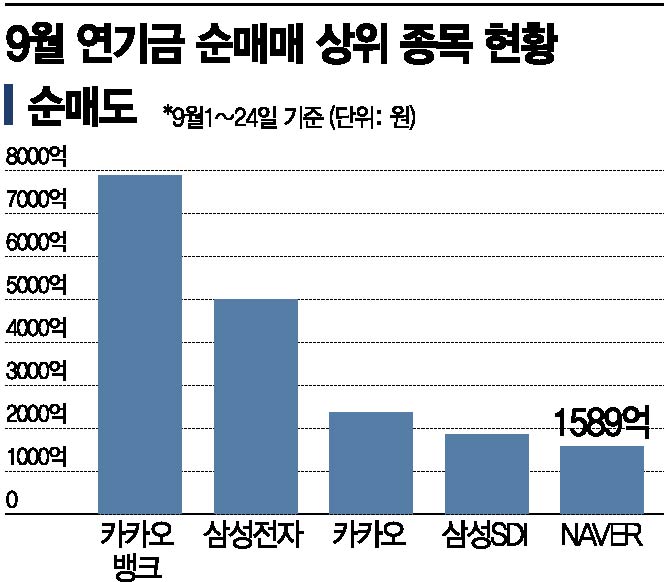

On the other hand, pension funds have focused their selling on companies such as Kakao, KakaoBank, and NAVER amid concerns over government big-tech regulations. The stock most heavily net sold by pension funds this month was KakaoBank, with total sales amounting to 788.5 billion KRW. Following were Samsung Electronics (-499.2 billion KRW), Kakao (-236.6 billion KRW), Samsung SDI (-186.2 billion KRW), and NAVER (-158.9 billion KRW), all ranking among the top net sold stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)