Supply Performance of Korea's Top 5 Banks Accounts for 81.3% of Total

[Asia Economy Reporter Park Sun-mi] In the first half of this year, Saehee Hope Holssi supplied 1.8 trillion KRW, achieving 51.3% of the annual supply target of 3.5 trillion KRW. The supply performance of the five major domestic banks accounted for over 80% of the total.

According to the "2021 First Half Saehee Hope Holssi Supply Performance" released by the Financial Supervisory Service on the 27th, the supply performance of Saehee Hope Holssi by domestic banks in the first half of this year was 1.7938 trillion KRW (106,940 people), achieving 51.3% of this year's supply target. Despite unfavorable supply conditions such as a decrease in branch visitors due to COVID-19, steady supply continued thanks to the banking sector's efforts to support low-income and vulnerable groups. At this pace, it seems likely that the annual supply target will be smoothly achieved.

Saehee Hope Holssi is a customized loan product for low-income or low-credit groups who find it difficult to get loans from banks, with separate screening criteria established. It targets those with an annual income of 45 million KRW or less and a personal credit score in the bottom 20% (previously credit grade 6 or lower), or those with an annual income of 35 million KRW or less regardless of credit rating. The interest rate is capped at 10.5% per annum, and banks autonomously decide within a maximum loan amount of 30 million KRW. Additional support of 5 million KRW and interest rate reductions are provided for borrowers who have repaid faithfully for over one year, and preferential interest rates are available for vulnerable groups.

By bank, NongHyup Bank supplied the most at 339.5 billion KRW, followed by Shinhan (299.4 billion KRW), Kookmin (291.7 billion KRW), Woori (266.9 billion KRW), and Hana (260.4 billion KRW). The five major domestic commercial banks' Saehee Hope Holssi supply performance totaled 1.5 trillion KRW, accounting for 81.3% of the total performance.

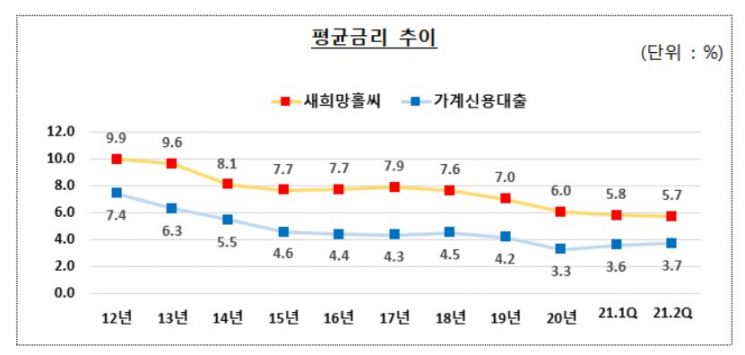

The average interest rate for Saehee Hope Holssi in the first half (newly issued loans) was 5.70%, down 0.45 percentage points from 6.15% in the same period last year. Since 2017, the decline has been greater than the average interest rate for household credit loans, continuously narrowing the gap with household credit loan rates. Loans to low-credit (bottom 10% credit score) or low-income (annual income of 30 million KRW or less) borrowers accounted for 91.2%, indicating a significant contribution to improving banking accessibility for low-income and vulnerable groups struggling due to COVID-19.

A Financial Supervisory Service official stated, "Since its launch in 2010, a total of 2.15 million people have been supported with 27.6 trillion KRW up to the first half of this year," adding, "We plan to actively strive in the second half of the year to achieve the overall supply target."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.