Companies with Principal Repayment Due from October 2021 to March 2022... Up to 6-Month Maturity Extension

[Asia Economy Reporter Kim Cheol-hyun] The Ministry of SMEs and Startups (Minister Kwon Chil-seung, hereinafter referred to as the Ministry) and the Small and Medium Business Corporation (Chairman Kim Hak-do, hereinafter referred to as SBC) announced on the 27th that they will extend the special maturity extension and repayment deferral for SME policy funds until March 31, 2022, considering the management situation of small and medium-sized enterprises due to the prolonged COVID-19 pandemic.

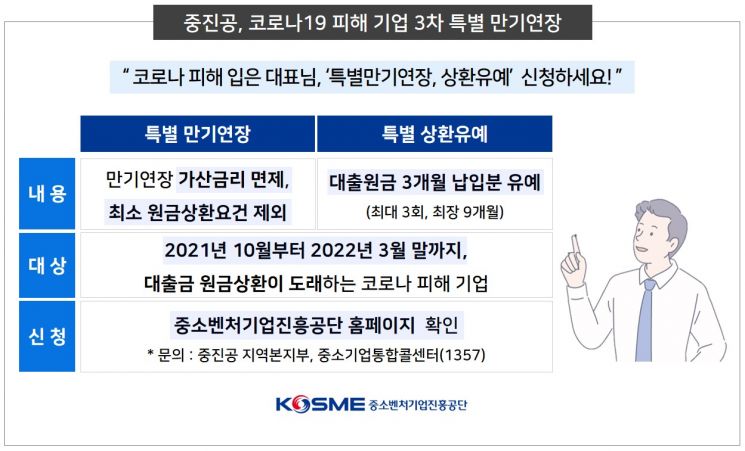

The Ministry and SBC have implemented special maturity extensions and repayment deferrals twice since the outbreak of COVID-19 last year. This year, to help SMEs overcome the crisis caused by the continued COVID-19 situation and recent interest rate hikes, they decided to implement the third special maturity extension and repayment deferral.

The special maturity extension targets SMEs whose principal repayment is due from October this year to the end of March 2022 and whose sales have decreased due to COVID-19 damage, extending the loan principal repayment maturity by six months. The special repayment deferral exempts three months of principal repayments regardless of the sales decrease condition. Detailed information on applying for the special maturity extension and repayment deferral can be found on the SBC website, and inquiries can be made to SBC’s 32 regional headquarters and branches or the SME Integrated Call Center.

Chairman Kim Hak-do said, "As the management difficulties of SMEs and startups continue due to the prolonged COVID-19 pandemic, we are extending the application period for the special maturity extension until March next year in line with the financial sector’s maturity extension measures," adding, "SBC will actively support companies to overcome difficulties as soon as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.