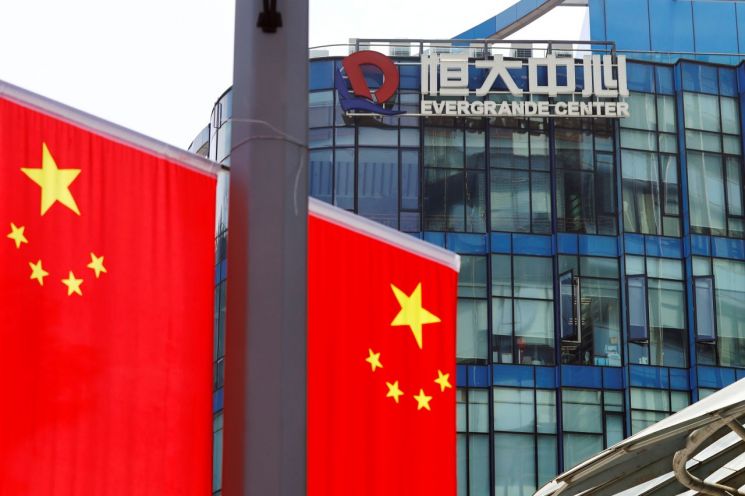

[Asia Economy Reporter Park Byung-hee] Evergrande Group, China's second-largest real estate developer facing a liquidity crisis, must repay over $600 million (approximately 706.8 billion KRW) in bond interest by the end of this year. According to Bloomberg News, the interest payments due in the fourth quarter alone exceed $500 million. These include $166.9 million in October, $82.5 million in November, and $255.2 million in December. Including the $83.5 million in dollar bond interest and 232 million yuan (approximately 42.3 billion KRW) in yuan bond interest, which appear to have been deferred on the 23rd, the total is expected to surpass $600 million.

Moreover, in January next year, Evergrande must pay $409 million in interest. Although the first hurdle was seemingly overcome on the 23rd through a payment deferral agreement, Evergrande's crisis remains ongoing. In this situation, the Chinese government currently shows no intention of providing direct support, making Evergrande's default (debt default) effectively a matter of time.

The Chinese government appears to be focusing on behind-the-scenes efforts to minimize the shock from Evergrande's default rather than supporting the liquidity-stricken Evergrande Group.

According to Bloomberg News and The Wall Street Journal, the Chinese government has issued separate directives related to the Evergrande situation to Evergrande itself, local governments, and state-owned enterprises.

Sources report that recently, Chinese financial authorities met with Evergrande representatives, emphasizing the completion of under-construction housing and the repayment of individual investors' funds, instructing them to avoid short-term defaults. Additionally, local governments and state-owned enterprises were directed to prepare for Evergrande's bankruptcy. In particular, local government agencies and state-owned enterprises were instructed to take action at the last minute if Evergrande fails to handle matters orderly.

Judging from these directives, the Chinese government seems to be focusing on minimizing the impact of a default rather than bailing out Evergrande, not ruling out the possibility of default.

In fact, insiders say the government only instructed Evergrande to avoid short-term defaults but did not provide specific solutions on how to do so, and there appeared to be no intention to support Evergrande.

The Chinese government sees no clear justification to support Evergrande. Evergrande expanded its business through reckless borrowing, while the Chinese government has recently emphasized debt reduction. Assisting Xu Jiayin, Evergrande's chairman and one of the country's wealthiest individuals, contradicts President Xi Jinping's policy of addressing wealth inequality and promoting 'common prosperity' for all.

Although the prospect that Evergrande's bankruptcy could lead to a Chinese economic crisis might justify government support, there are also expectations that the government can adequately manage Evergrande's default situation. Accordingly, the government appears to be focusing primarily on behind-the-scenes efforts to prevent the situation from spreading unpredictably.

There are also forecasts that the government will allow Evergrande's shareholders and creditors to bear losses while focusing on consumer protection. This seems intended to prevent public opinion from worsening ahead of President Xi Jinping's bid for a third term next year.

Recently, protests by ordinary consumers affected by Evergrande have been ongoing daily in front of Evergrande buildings across China. From President Xi's perspective, who is aiming for a third term, continued protests are unwelcome. The directives to complete housing under construction and to repay individual investors' funds are interpreted as measures focused on consumer protection rather than shareholders or creditors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)