Bank of Korea 'Overseas Economic Focus'

[Asia Economy Reporter Kim Eunbyeol] Recently, as the COVID-19 Delta variant spreads, there are concerns that the pace of economic recovery may slow down. However, with disruptions in crude oil supply also occurring, oil prices are rising. The Bank of Korea forecasts that oil prices will remain around $70 per barrel for the time being.

On the 26th, the Bank of Korea stated in its 'Overseas Economic Focus' report, "According to projections using an oil price model, international oil prices (based on Dubai crude) are expected to hover around $70 per barrel in the second half of this year and then gradually stabilize from next year onward." The Bank of Korea made this analysis using an oil price DSGE model.

However, the Bank of Korea added, "Downside factors such as the spread of variant viruses and the strengthening of the US dollar, along with upside factors such as delays in production recovery and the possibility of abnormal cold waves, are intersecting, so uncertainty about future oil price trends remains significant."

As of the 22nd, international oil prices (Dubai crude) stood at $73, significantly exceeding pre-COVID-19 levels. The average Dubai crude price in 2019, before the pandemic, was $63.2. Oil prices fell to the mid-$60 range in August but recently rebounded to the low $70 range. This is because, while the rapid spread of the Delta variant has increased uncertainty about the pace of global economic recovery, on the other hand, some crude oil supply disruptions have also occurred.

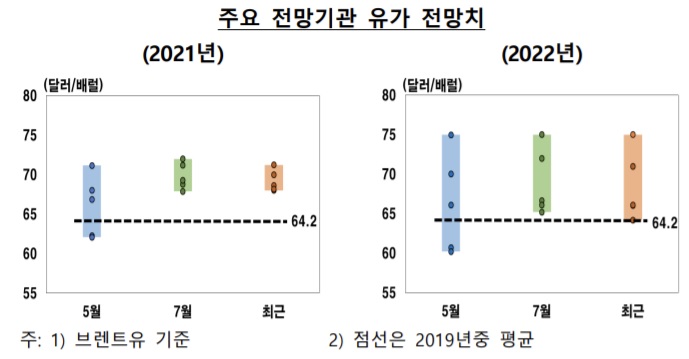

Major forecasting institutions have also slightly lowered their oil price forecasts reflecting the recent decline since August, but their annual forecasts remain higher than pre-crisis levels.

Supply-demand imbalances are expected to persist due to crude oil supply falling short of demand recovery, and the inflow of speculative funds is also understood to have partially contributed to driving up oil prices. Goldman Sachs stated, "With crude oil demand recovery in the US and Europe accelerating faster than expected, crude oil inventories are decreasing. Meanwhile, constraints on US shale oil production increases and OPEC+'s conservative production increase policy are expected to continue for the time being."

As inflation risks expand, investors' portfolio adjustments and speculative fund inflows have increased compared to the average of the past five years. However, most institutions maintain the view that the current oil price strength will gradually weaken after the end of this year. Goldman Sachs forecasted this year's oil price at $71.2, JP Morgan at $70, and the US Energy Information Administration (EIA) at $68.6.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.