Personal Loans, Interest Rates in the High 2% Range and Limits Up to 200 Million Won Announced

Attractive Deposit Products... Industry Talent Also Joining

[Asia Economy Reporter Kiho Sung] The outline of Toss Bank, which is set to launch early next month, is gradually emerging. In particular, it is attracting attention with more favorable interest rates and loan limits compared to other banks, signaling that competition among the three internet-only banks is about to intensify.

According to the financial sector on the 26th, Toss Bank posted on its homepage that as of the 25th, the interest rates for unsecured loans range from 2.76% to 15.00% per annum, with loan limits from a minimum of 1 million KRW to a maximum of 270 million KRW. Although conditions may vary, the industry expects Toss Bank's unsecured loan products to have a minimum interest rate in the high 2% range and loan limits between 100 million and 200 million KRW.

Given that recent unsecured loan interest rates at commercial banks are capped at around 4%, and loan limits have been reduced to within annual salaries, Toss Bank's terms are considered groundbreaking.

Toss Bank has already introduced attractive deposit products. The previously announced "2% per annum with no conditions" Toss Bank account pays 2% interest annually on a demand deposit account without any restrictions on subscription period or deposit amount. If customers open a Toss Bank account through pre-registration, 2% interest is calculated from the date the money is deposited and paid monthly.

The debit card is also designed to offer various benefits without any monthly spending requirements. When using the card in five major categories (coffee, fast food, convenience stores, taxis, public transportation), users receive an immediate cashback of 300 KRW per category daily (public transportation cashback is credited the next day). This amounts to a maximum monthly cashback of 46,500 KRW. Overseas, whether online or offline, 3% of the spending amount is instantly returned as cashback. This is among the highest benefits offered by debit cards released domestically. Transfer fees, as well as domestic and international ATM withdrawal and deposit fees, are unlimited and free. These benefits apply during the first season until January 2 next year, and Toss Bank plans to offer new benefits tailored to customers' spending patterns each season.

Alongside this, Toss Bank is strengthening its foundation by hiring various personnel. According to the financial sector, many applicants from commercial banks and other internet banks recently applied for experienced positions at Toss Bank, with many being hired. The biggest reason applicants flock to Toss Bank is its growth potential. In June, investors valued Toss Bank's parent company, Viva Republica, at 8.2 trillion KRW. This is similar to the recent conservative valuation of K Bank at 8 trillion KRW by global investment bank Morgan Stanley.

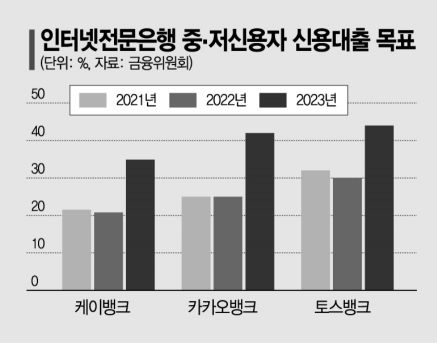

Industry insiders believe that although Toss Bank offers attractive products, the key to success ultimately lies in how many loans it can attract from low- to mid-credit borrowers. Toss Bank has presented a goal to the Financial Services Commission to achieve a loan ratio for low- to mid-credit borrowers starting at 30% this year and reaching 44% by 2023. This far exceeds Kakao Bank's 30% and K Bank's 32%. Since the market for low- to mid-credit loans is not large, the industry is focusing on how aggressively Toss Bank will target this segment using advanced credit evaluation models.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)