[Asia Economy Reporter Lim Cheol-young] The Seoul Metropolitan Government will support insurance premiums for the ‘Traditional Market Fire Mutual Aid’ insurance, which helps quickly restore damages in case of fires in traditional markets and also protects the livelihood safety net of merchants.

On the 27th, Seoul announced that it will implement this for the first time this year by supporting 60% of the annual insurance premiums for about 5,100 traditional markets, with the city and autonomous districts sharing the cost. For example, a traditional market merchant who subscribes to a fire mutual aid insurance with a coverage amount of 60 million KRW can receive support of about 122,520 KRW, which is 60% of the total premium of 204,200 KRW.

Since 2017, the Ministry of SMEs and Startups has been promoting the ‘Traditional Market Fire Mutual Aid Insurance,’ a mutual aid product exclusively for traditional markets that is cheaper than general private insurance by raising mutual aid funds through merchants’ premium payments and having the government support operational costs. It is a pure protection-type product without maturity refunds, reflecting the characteristics of traditional markets, and guarantees full compensation for losses within the insured amount limit.

Traditional markets are exposed to constant fire risks due to poor conditions, and even a small spark can cause huge property damage and easily spread to adjacent stores, threatening not only the merchant’s own damage but also the survival rights of neighboring merchants. Nevertheless, the current fire insurance subscription rate for traditional markets is only 37.7%, including private and fire mutual aid insurance. Among these, 55% (3,088 people) of all subscribers have subscribed to products under 10,000 KRW, resulting in low coverage amounts and inadequate compensation. Therefore, Seoul plans to increase the subscription rate of fire mutual aid insurance by reducing merchants’ financial burden through premium support.

The support target is merchants operating in traditional markets who have registered their business and subscribed to insurance with a coverage amount of 20 million KRW or more (mandatory third-party liability insurance) between January and the end of October this year. The support limit is 60% of the premium, and depending on the insurance product, support ranges from 43,320 KRW to 122,520 KRW. Retroactive application is possible even if the premium has already been paid.

Merchants who subscribe to insurance products covering up to 60 million KRW of their own damage are also required to subscribe to fire liability insurance, enabling compensation up to 100 million KRW for third-party and property damage in case of an actual fire.

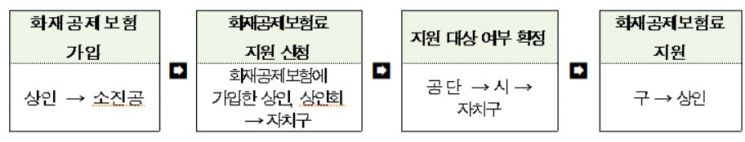

Traditional market merchants wishing to subscribe to ‘Fire Mutual Aid Insurance’ can submit an application form to the Small Enterprise and Market Service or apply through its website, then apply for premium support at their autonomous district office.

Han Young-hee, Director of Labor, Fairness, and Coexistence Policy at Seoul City, said, “Fire insurance, started to protect traditional market merchants who suffer fire damage but do not receive proper compensation, has had a low subscription rate due to premium burdens. We will encourage more merchants to subscribe to mutual aid insurance through premium support from Seoul and autonomous districts, and actively promote it to prevent cases where merchants miss subscribing due to lack of information.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.