Available at an annual rate of 2.90% depending on the product and maturity

[Asia Economy Reporter Kwangho Lee] Korea Housing Finance Corporation announced on the 24th that it will raise the interest rate of the long-term fixed-rate, installment-repayment mortgage loan, Bogeumjari Loan, by 0.20 percentage points in October compared to the previous month.

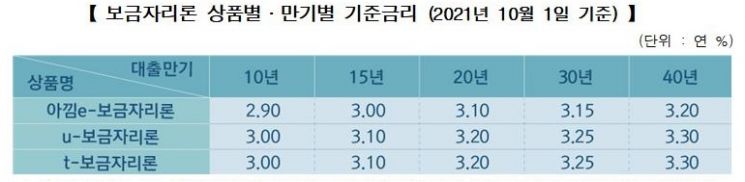

Accordingly, based on applications completed on the 1st of next month, the u-Bogeumjari Loan and t-Bogeumjari Loan will have fixed interest rates from 3.00% per annum (10 years) to 3.30% (40 years), and the Akim e-Bogeumjari Loan will have rates 0.1 percentage points lower, ranging from 2.90% (10 years) to 3.20% (40 years), applied as the base rate until maturity.

A Korea Housing Finance Corporation official stated, "Due to the rise in government bond yields, we have adjusted the Bogeumjari Loan interest rates," and added, "If you complete your Bogeumjari Loan application in September, you can receive the pre-adjustment interest rate."

Meanwhile, the low-income preferential program launching on the 27th of this month offers a 0.1 percentage point interest rate discount compared to the Bogeumjari Loan. Applications are available for households with a combined annual income of 45 million KRW or less and a housing price of 300 million KRW (500 million KRW in the metropolitan area) or less.

There are no special restrictions for loan maturities from 10 to 30 years under the Bogeumjari Loan, but for the ultra-long 40-year maturity Bogeumjari Loan, applications are limited to newlywed households where the applicant is 39 years old or younger or within 7 years of the marriage registration date (including those planning to marry within 3 months), so this should be noted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.